Expected record breaking Inheritance Tax receipts further demonstrate the need for financial planning

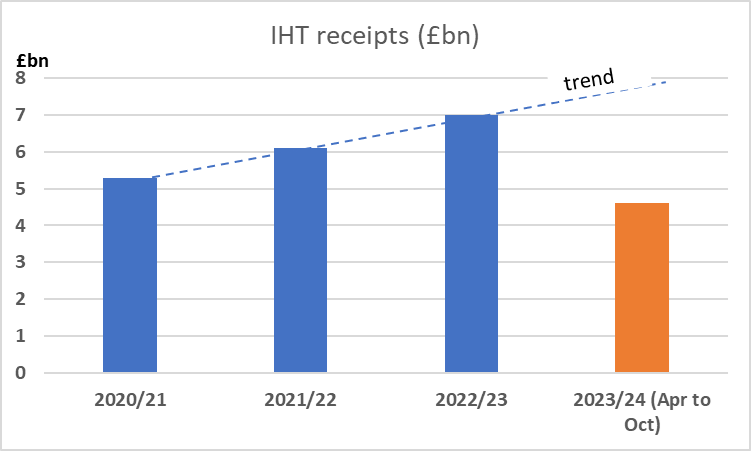

- For April 2023 to October 2023 these are £4.6 billion, which is £0.5 billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may cut the headline rate of IHT in the Autumn Statement tomorrow.

Andrew Tully, Technical Services Director at Nucleus said: “It looks set to be another record-breaking year for IHT receipts, unless the Government moves to cut the headline rate as rumours suggest. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions.

“Engaging early with good planning and advice can help to reduce or mitigate IHT. There are a number of ways advisers can help manage an estate for IHT purposes including setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors: