Nucleus comments on IHT Tax receipts

HMRC announces the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk).

- Total HMRC tax receipts for April 2023 to December 2023 are £580.8 billion, which is £26.0 billion higher than the same period last year.

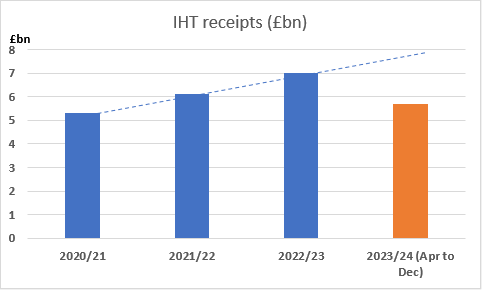

- IHT receipts for April 2023 to December 2023 are £5.7 billion, which is £0.4bn billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the March Budget.

- However, even if IHT were scrapped it is possible some tax would apply to assets passed on after death – for example, Capital Gains Tax.

- The Labour party has said that if it wins the election it would reverse any abolition of IHT.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said:

“It looks set to be another record-breaking year for IHT receipts. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions, given this year’s receipt are on track for around £8bn.“There are rumours the Government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial. Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

To download the PDF click here

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309