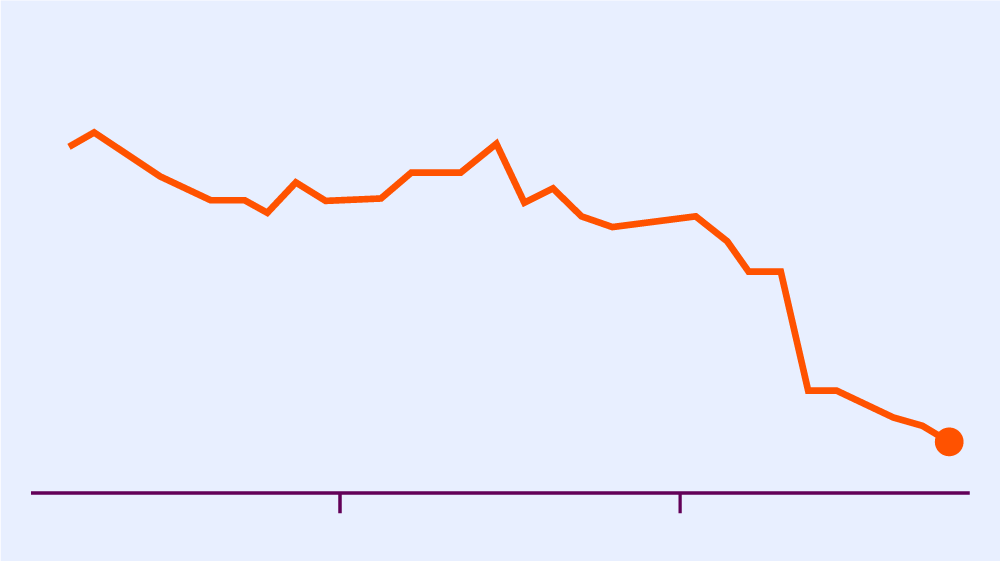

Kwasi Kwarteng’s mini-budget sent shockwaves through financial markets as he announced a series of tax cuts and higher borrowing that one think tank called ‘the most dramatic, risky, and unfounded mini-budget’ in history.

But what do advisers and planners think? Before his dramatic u-turn on the plans to scrap the 45p tax rate, I asked some.

Tom Skinner, Barnaby Cecil

Truss’ view is that we need much higher levels of revenue to pay down the debt, and the way to do that is to try and stimulate growth.

It feels like this is her big experiment: she could well be out of office in a couple of years, so this might be her attempt to try and make something dramatic happen – and if it doesn’t work, she’s out anyway.

May be markets will settle down and this is just the immediate reaction. Economists don’t always get everything right - perhaps this is the shot in arm Britain needs.

Tamsin Caine, Smart Financial

My new clients are generally divorcing or dissolving a civil partnership. They’re sometimes lower paid, relying on child maintenance and universal credit. Their options of increasing their hours may be limited by needing to look after their children. Now they’re in a position of feeling that their universal credit is threatened if they are unable to do so.

Single parents already lose out financially and this aspect doesn’t seem to have been considered. The mini budget seems to be focused on reducing taxes for the higher paid, rather than looking after those at the poorer end of society who may find they are choosing between eating and being warm this winter.

While the tagline is about creating growth, I can’t see how the actions taken in the mini budget will have that effect. Surely corporation tax cuts would have been more likely to impact growth more widely?

Alasdair Coutts-Britton, BetterWorld Financial Planning

The mini Budget / ‘fiscal event’ is turning out to be quite a big deal. I wonder where it will be this time next week? The Bank of England seems to have miscalculated with its 0.5% interest rate rise and will need to go up again in November for Sterling to compete.

I’d say it’s far too early to try to judge the result of this and the current excitement about the Sterling / Dollar / Euro. It would be unwise to make snap decisions around macroeconomic events. The effect of cuts to payroll taxes, freezing corporation tax, ditching a cap on banker bonuses and spending billions to subsidise energy bills over the next two years is yet to be seen.

Certainly, the immediate reaction of market participants suggests they’re largely unconvinced by the government’s actions and fear the increase in debt will lead to unsustainable public finances and further exacerbate inflation, which I suspect will be the key driver in the short term.

Active management I feel is better placed in the current circumstances; the focus should continue to be on returns over the medium to long term.

Peter Watts, KWL Wealth

Investors' resolve has been tested over the past nine months and the government’s announcement has added fuel to the fire.

Considering the landscape an artist (investor) would have painted on the 8 December 2021, life was returning to normal, and I’ve no doubt the outcome would be a beautiful painting of the English countryside.

How would the artist now portray the landscape in front of them? With high inflation, rising interest rates, Covid-zero policy in Asia, Russia's war with Ukraine, central bank policy, and as I write this, planned tax cuts by the UK government: a scribble? Or maybe a piece of ‘modern’ art with a few buckets of paint thrown at the canvas?

Advice to clients: as you adjust to the new landscape, keep your emotion out of it, and stay disciplined. Have a plan in place, rebalance regularly, view volatility as an opportunity, and take advantage of tax incentivised wrappers, such as ISAs, Pensions, VCTs, EISs.

Richard Johnston, AAB Wealth

Arguably, the lessons to be learned here are a) don’t introduce such sweeping changes without details of the funding and b) work with the Bank of England instead of against them.

But in terms of the actual tax cuts themselves, it’s a shame they aren’t being given credit in the mainstream media for the optimism they represent – something that the country has been lacking recently – and the assistance they will provide to families at this time. Here in Scotland, all eyes will be on Holyrood – it remains to be seen how the Scottish government will react to this budget.

Matt Wood, Asset Management Financial Advisers

It could be prudent to look at the recent announcements in terms of how they’ll potentially dovetail with further policies Truss is yet to implement, and the impact on further topics such as foreign policy and Brexit, climate and green energy, and health and social care.

The record lows reached by the pound have echoed the uncertainty and added to the doom and gloom. To introduce a glimmer of positivity, it could be said that given the vast majority of profits for FTSE 100 companies is derived in dollars, then the reality is that if GBP falls then dollar revenues become more valuable when converted back into GBP and hence contribute to positive growth.

Whichever stance we take it’s ultimately the case that the British prime minister is facing a massive pile of problems including a potentially painful, self-inflicted, financial crisis – we’ll have to see whether Truss and her team can find us a way out.