Last month Nucleus called for an independent long-term savings commission by writing an open letter to pensions minister Paul Maynard explaining the need to end the cycle of short-term thinking and the politicising of pensions.

We’ve long proposed this notion and so it’s great to see Nucleus supporting this. So how can we make it happen, and what are the challenges?

Setting objectives

Let’s start with the challenges, one of which could come from MPs who, understandably, will retreat from anything that appears to be affecting or diluting their decision-making powers. This means the first thing that the commission needs to do is to establish that this is about supporting the work ministers do, not replacing it.

At the same time, it’s true that MPs have lots on their plates, and very little time; in addition, they may lack the in-depth expertise to make the sorts of policy decisions that are really needed here. So we also need to make it clear that the role of the commission is to harness the expertise of its members, and in collaboration with industry, create a detailed and holistic analysis of the current financial landscape and consumer challenges. Then continuing the collaboration and through an evidence based approach, produce a set of recommendations for the government to consider. We’d hope that whichever party is in power after the next election finds that credibility and evidence hard to ignore.

A general consensus

Achieving a general consensus on what we want to achieve will enable the commission to go away and do its work, but what should that be? One of the biggest findings from Nucleus’s inaugural Retirement Confidence Index was people potentially overstating their confidence levels when it comes to retirement, so we need to address financial education. But we need to take into account the financial pressures people are already facing.

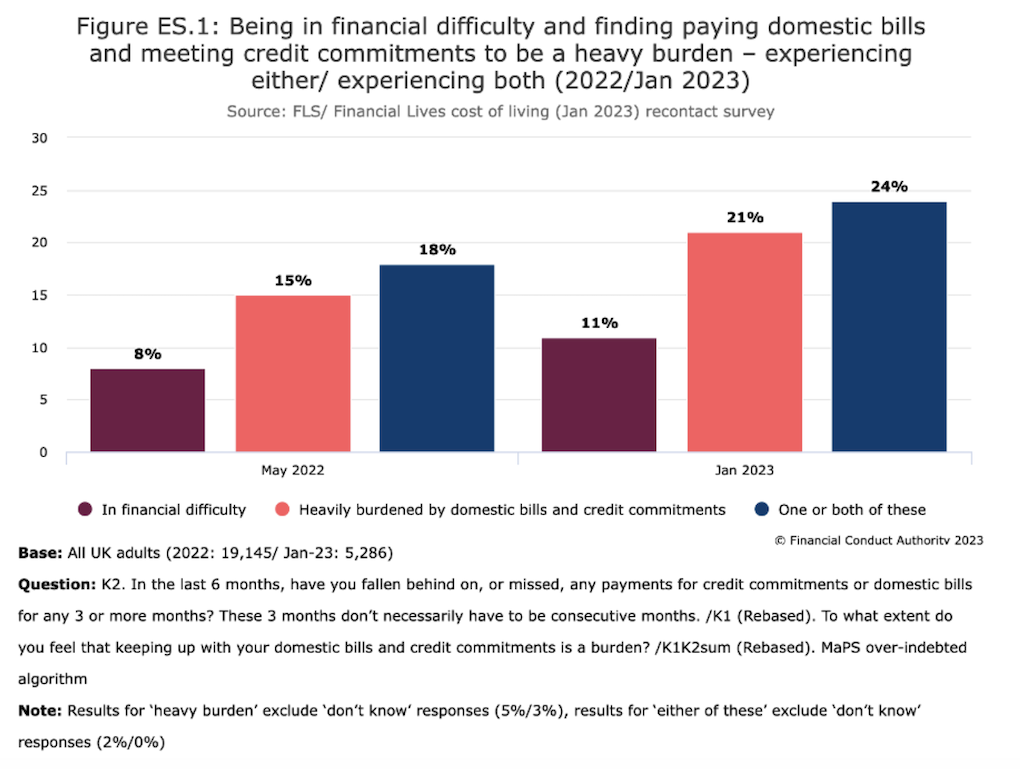

The FCA’s Financial Lives 2022 Survey – which runs every two years – found that 12.9 million UK adults had low financial resilience. ‘Low financial resilience’ refers to those who are in financial difficulty because they have missed paying utility bills or credit commitments in three or more of the previous six months; because they could quickly find themselves in difficulty as they are heavily burdened by their existing commitments, or because they have very limited savings.

In this context, pensions can’t be seen to be sacrosanct. The commission needs to ensure it joins the dots between retirement and the financial challenges households currently face for it to be truly meaningful.

Targeted support regime

Then comes the question of advice. Despite the fact that three-quarters of consumers say they wouldn’t be comfortable to invest without support from an expert, only 8% of people took advice in 2022 – the same figure as in 2020.

We know that full-fat regulated advice is prohibitively expensive for many; the flipside of course is that sometimes a little knowledge is a dangerous thing – what if people try to do it themselves?

In response to this, the FCA is supporting a targeted support regime which allows authorised firms to guide their customers towards better outcomes based on what other people 'like them' would find suitable. This is about authorised firms utilising the data they have on their clients to steer them in the right direction through personalised support. For example, they may be able to identify that a client is taking a 10% level of drawdown which is unsustainable in the long-term, and alert them to that through a targeted email, with links to specific content.

This is never going to be about being one-size-fits-all, but about trying to find a way to try to close that support gap with something that is meaningful to the recipient.

From an adviser’s perspective, clearly there needs to be demarcation around this, if they wanted to get involved in targeted guidance themselves. Perhaps many will see this as a way of helping a different target audience and may prompt consumers into considering whether they need regulated advice.

Stable savings measures

Pension planning is a hard enough sell as it is: people don’t want to put their money away for some far-away lifetime event, especially if they don’t have any confidence in what the rules will be by the time they get there.

The constantly changing rules is incredibly harmful to retirement confidence and is a major barrier to driving up levels of engagement. Understandably, people would be foirgiven for feeling as if they’re just pawns in a game.

The potentially stabilising impact of a long-term savings and investing commission would be a hugely positive step for consumers and industry. You’d hope that any government would also see the advantages, and that by linking up with industry to create a cohesive, long-term approach represents positive action in this area. It could even be a vote winner.

Building on the success of auto-enrolment

One final and hugely important factor is that the commission needs to have cross-political party support in its aims and objectives.

Automatic enrolment is one key policy that has been a huge success in getting millions more people to save for their retirement within the Defined Contribution environment. This was proposed by an independent pensions commission in 2005 and had from outset, and continues to have, wide cross-political party support. The concept has since expanded UK pension coverage to 88% of eligible employees as of April 2021, according to the Office for National Statistics.

We hope the commission can build on this as a successful predecessor, and by doing so, establish a framework that ensures consistency and effectiveness in long-term savings policies.

This stability is crucial for fostering trust and confidence among savers and stakeholders alike, paving the way for a more secure financial future for all.