The announcement that the UK will hold a general election next month has sparked concerns among some investors.

Will economic growth change? Will tax rates change? Will my investments be impacted? Will UK equities underperform? What does this mean for a portfolio with UK equity allocations? These are understandable concerns, so let’s start by looking at the UK equity market.

Impact of general elections on the UK equity market

There is a general sense that Conservative governments are more likely to be ‘pro-growth’ and ‘pro-business’. In turn, this may cause investors to worry that if a Labour government was elected, it might create a lower UK stock market return than when their Conservative predecessors were in power.

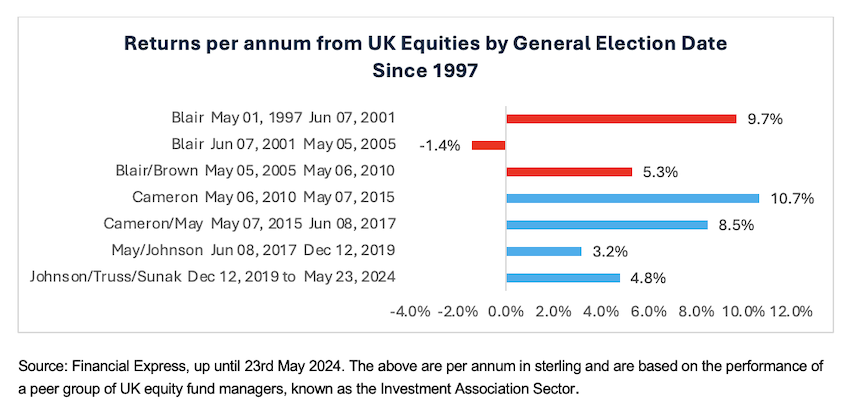

With this in mind, we’ve examined the impact of general elections on the UK equity market since Blair was first elected in 1997. The results are shown below, with Labour in red and Conservatives in blue.

The chart illustrates that UK equity returns have mostly been positive since 1997. This suggests that the outcome of the general election and the party in power may not have a significant impact on the returns.

For instance, when Blair took office in 1997, it coincided with the tech bubble, which led to high market returns during his first term and lower returns during his second term.

Cameron is another anomaly. During his first term in 2010, UK equities saw excellent returns, but not because of his policies. Instead, equity markets were recovering from the global financial crisis, which had bottomed the year before. Despite presiding over the Brexit vote, UK equity markets performed remarkably well during this period.

It seemed that neither Brexit nor Cameron's leadership had much impact on the markets. The very low-interest rate environment was the main driving force behind market performance at that time.

The May and Johnson years

We suspect clients might be surprised to learn that the period from 2017 to 2019 under the leadership of May and Johnson saw lower returns than from 2019 to 2024 under the leadership of Johnson, Truss, and Sunak. Despite overseeing the Covid-19 pandemic, even this global event didn’t stop UK equity markets from delivering quite reasonable returns.

This all seems quite logical to us. To take this one step further, governments have limited economic influence despite their oversight of significant events such as the Iraq war, the global financial crisis, Brexit, and the Covid-19 pandemic. What tends to matter most in economic terms is where we are in the economic cycle.

If the economy is doing incredibly well (late cycle) it usually means that growth may be slower or even negative going forward. In contrast, if we are coming out of a deep recession (early cycle) the subsequent period will likely show better economic growth. The stage of the economic cycle matters, more than the government.

To conclude

At Fundhouse, we have no plans to change our model portfolio allocations due to the announcement of the UK general election.

This is because what we believe really matters when investing in equities is the initial valuation. In essence, when valuations are high (such as during the tech bubble of 2001) subsequent returns are typically low. Conversely, when valuations are low (such as after the Global Financial Crisis in 2009) returns are likely to be high. When valuations are reasonable, you tend to receive fairly average returns, as was the case in most periods. Additionally, governments seldom directly influence economies. What matters most is the stage of the economic cycle.