Expert Wealth recently won Adviser Firm of the Year South East at the Professional Adviser Awards. We catch up with them to find out more about their business and how they plan to scale while remaining ‘boutique’.

What does it mean to win this award?

We entered the Professional Adviser awards last year with no expectation of winning anything - so much so that we didn’t bother buying a table! On the night of the awards, I was away cycling in Majorca and fellow Director John was on holiday in Kenya. I picked up my phone later the night to find several messages saying we’d won.

This year we entered again and took a table.

It’s been good for marketing. We’ve had several people contact us referencing it – and more people from London are getting in touch as a result.

It’s great for clients as well – they like it because it shows our consistency and development as a business and it's often the source of conversation when they come into the office.

Describe your investment approach

We’re absolutely financial planning led. We have an evidenced-based, systematic, centralised investment proposition constructed using low-cost, passive investment funds. Portfolio constructions comprise global equities by market cap weight with small and value factor tilts, and global short-dated government and corporate bonds.

It might be simple, but it’s good. It’s transparent and highly liquid. Total cost of ownership for clients is under 1.5% pa - we believe that offers good value for money. But we test that by regularly benchmarking ourselves against things such as yearly Vouched For surveys.

What’s your main challenge at the moment?

We have two planners, seven support staff, and service 190 families, with assets under advice of £128 million. Our biggest current challenge is capacity.

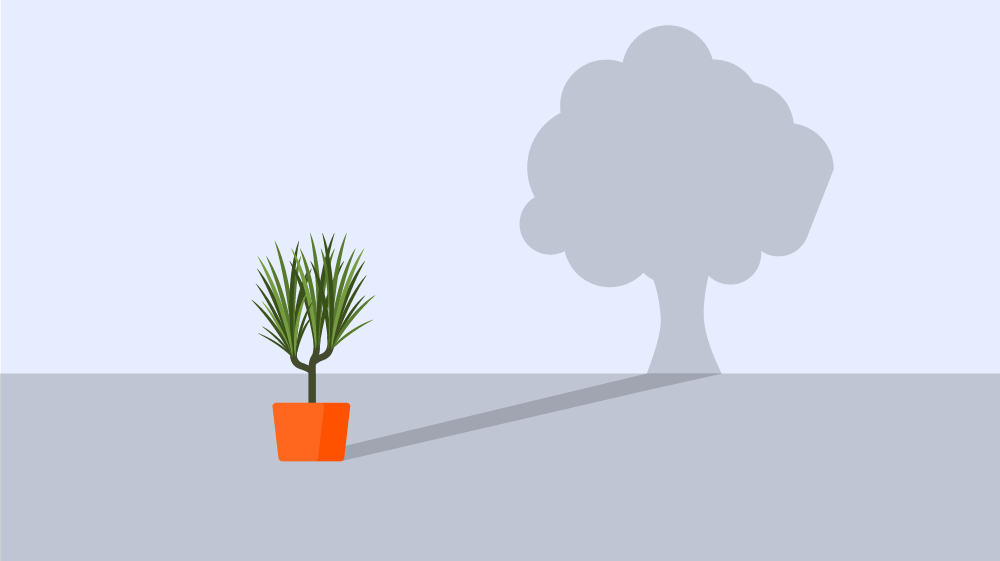

We’re working with Brett Davidson to increase our capacity - that doesn’t mean we want to scale the firm; we’ve always planned to stay ‘boutique’. So instead, what we’ve done is to set up two ‘diamond’ team structures of four which includes an adviser, a paraplanner, a client relationship manager and a trainee. This means clients have a relationship with the team rather than an adviser and can continue to deliver exceptional client service.

That’s been step one.

Step two is to promote internally so we can look to create a third diamond team. One of our client relationship managers has been promoted to paraplanner. We also have another paraplanner starting in July, along with a new associate adviser who is Chartered. We’re creating a portfolio of clients that he’ll look after, and then we’ll have three diamond teams instead of two.

The longer-term plan is that in about three years from now if the CRM who has just become a paraplanner gets through his qualifications to become adviser then we’ll create a portfolio of clients for him and we’ll be up to four diamond teams.

So this strategy has created a career path for the team’s personal development. We have other younger team members progressing through their early career and an undergraduate who we hope may join us after she graduates in 2024. We also regularly have students from local schools join us for work experience. We believe this is an important part of giving back to our local community and important for the future of our profession.

How do you communicate the value of planning?

Quite often people who haven’t worked with a financial planner before will come in and say “I’ve got a problem with my pension.” For example, last year we had a couple of handfuls of enquiries where the prospect was holding lifestyle funds – they were in the midst of being switched into long-dated gilts, which had dropped by 30% or more in 2022.

So typically clients come in displaying a transactional ‘problem’ but when you start talking to them about what’s important about the money, what it needs to do for them etc, you see the penny drop and they realise that there’s a lot more at stake. When you create the space for a client to talk, and when you listen to them properly, the relationships you deliver are incredible. Many clients say to us that no financial adviser has ever asked the sort of questions we ask, or bothered to listen to them.

For most people, it boils down to one question “Are we going to be ok?” For many, thinking about the future creates anxiety, there’s always a nervousness at a first meeting, particularly if they haven’t used a planner before. We’re here to deliver great financial planning outcomes and that starts with creating a safe physical and mental space for people to talk.