As we headed into 2023, most of the main institutional and independent research houses were calling for a difficult time for equity markets triggered by overvaluation – particularly in the US – unrealistically optimistic earnings estimates, the growing risk of a recession, inflationary pressures remaining more elevated than expected, and hence further tightening by central banks.

The forecasts for any bullish rally were focused on being contained and limited. The risk was skewed to the downside. As a reference point the S&P 500 started the year at 3866 while the FTSE 100 started the year at 7468.

No doubt it was to some commentators’ annoyance that during January into mid February equity markets rallied in opposition to these views. The S&P 500 reached 4195 and the FTSE 100 finally breached the key 8000 mark. This rally appears to have been fuelled by retail investors buying against the increasing rhetoric of institutional banks strategists. Indeed one prominent US investment house considered the rally to be similar to the ‘death zone’ when you climb Everest!

But for the retail investor and a few other commentators who argued a more positive case for equity markets, they would have felt vindicated in their views during the first six weeks of the year.

Since that point, the more bearish commentators will also now start to feel vindicated over their predictions, especially since the equity market volatility witnessed from the Silicon Valley Bank failure.

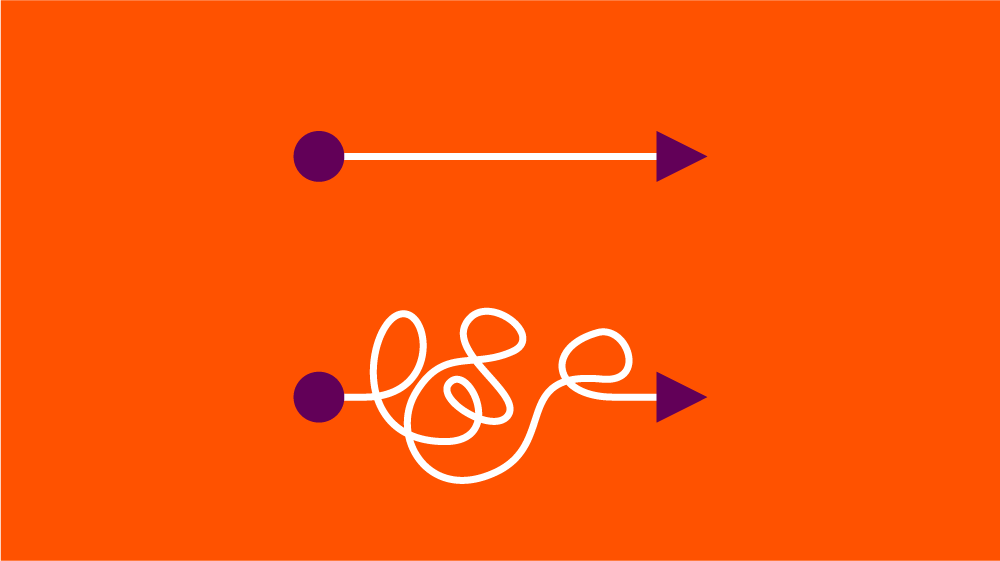

This pattern of wins on both sides of the argument is something we may need to brace ourselves for during 2023. This is not an uncommon pattern seen in markets, particularly when we all largely agree that we’re late in an economic growth cycle. But, looking back at history there is a cautionary tale for us to remember and that is how elongated this part of the cycle can be.

In the 1990s, particularly the latter part of the decade, among other things, we witnessed a period of higher inflation and therefore higher interest rates. During this time, growth had been supported by low interest rates from the Federal Reserve, the so-called Greenspan put; and throughout this period some commentators and well know names relentlessly called for the end of the equity bull market with a key argument being overstretched valuations.

However, arguably it took over two years for this event to reach its peak, if you assume the first sign of real tensions came with the Long Term Capital Markets (LTCM) incident in 1998, when government intervention had to be enacted to prevent a financial market collapse.

The current rhetoric has arguably similarities to this time, it also plays on investor’s behavioural fears of loss aversion. Then, and it appears now, investors are largely inclined to seeing through the less rosy outlook and there can be several explanations for why this is.

Despite pessimistic predictions taking up a lot of airtime (apparently we do not like hearing good news!) there are other key factors to consider, including time horizon. Industry professionals have arguably different motivations then retail investors. For the industry, time horizons appear to have shortened. Industry professionals’ compensations packages are focused on what they achieve in this year, rather than what they often argue is the longer-term objectives of their investments. While in the retail world the investor time horizon is generally much longer. Retail investors are building wealth for their family’s futures and there is no doubt that equity investing over a long period of time can improve this outcome.

So if they buy at what some commentators argue is over valuation this may not concern them enough to stay out of the market particularly if they are in an accumulation stage and they are looking 10 years out.

This leads us onto the next explanation: the power of compounding, and the key importance it makes for an investor’s longer-term wealth. To state the obvious if you are not invested you cannot benefit from the compounding returns offered by equity markets.

Furthermore, if an investor has entered their retirement phase, then there are investment strategies today, namely of managing different ‘pots’ of monies with different investment time horizons, which can look to protect and potentially increase these compounded returns.

So for 2023, expect a battle between longer-term and short-term time horizons to continue to wage and, while battles need to be chosen wisely, at the end of the day, everyone is likely to claim some form of victory.