Latest in the press

Our Technical Services Team regularly provides commentary and insight in the media to deepen your understanding of the ever-changing financial landscape.

Media commentary

The ONS today announced the increase in CPI for the year to September 2025 is 3.8%. This is one of the elements of the triple lock, the highest of which drives the increase to the state pension from April 2026. > Inflation and price indices - office for National Statistics

A few weeks ago, ONS confirmed the increase in average weekly earnings for the period to July 2025 – this was initially 4.7% but later revised upwards slightly to 4.8% > Average weekly earnings in Great Britain - Office for National Statistics

These are two of the elements of the triple lock, the highest of which drives the increase to the state pension from April 2026.

- The triple lock means state pensions increase by the highest of inflation, earnings and 2.5%

- These figures mean the increase in earnings is the highest element and therefore be used to determine the increase in many state benefits

- While the headline state pension increases by the triple lock, other parts of the state pension such as SERPS/S2P, the graduated pension, protected payments and benefits for deferring, will go up by CPI.

The new state pensions from April 2026

- The headline single tier state pension from April 2026 will go up by 4.8% to £241.30 a week, up from the current £230.25 a week

- The maximum basic state pension paid to those who reached state pension age before 6 April 2016 is currently £176.45 a week and it will increase to £184.90 a week

- The personal allowance remains frozen at £12,570 until at least April 2028. This means more pensioners will be liable to tax solely as a result of their state pension next year and into the future

- While these are the headline rates many people receive less.

Andrew Tully, Technical Services Director at Nucleus said:

“Pensioners will get another relatively substantial increase to the state pension from April 2026 which will be a welcome boost to many. However it means many more will pay income tax solely as a result of their state pension given the ongoing freeze to the personal allowance, and Government will need to consider the best process to easily allow these people to pay tax.

While the headline state pension increases by the triple lock, other parts of the state pension such as SERPS/S2P, the graduated pension, protected payments, and benefits for deferring, will go up by CPI which may be lower than earnings.

The Government has announced a review of the state pension age which will consider if and when state pension age moves to 68 and beyond. However rather than focus solely on state pension age, we need to consider the future of our state pension system as a whole. As well as state pension ages, this wider debate should consider a suitable level of state benefit, the future of the triple lock, differing life expectancy across the UK, and support for those below state pension age who aren’t able to work.‘

The history of the triple lock over the last ten years

| Year | CPI | Average earnings | Index used | Triple lock | Basic State Pension (individual) | New State Pension |

|---|---|---|---|---|---|---|

| % increase | £ per week | £ per week | ||||

| 2016-17 | -0.10% | 2.90% | Earnings | 2.90% | £119.30 | £155.65 |

| 2017-18 | 1.00% | 2.40% | Fixed | 2.50% | £122.30 | £159.45 |

| 2018-19 | 3.00% | 2.20% | CPI | 3.00% | £125.95 | £164.35 |

| 2019-20 | 2.40% | 2.60% | Earnings | 2.60% | £129.20 | £168.60 |

| 2020-21 | 1.70% | 3.90% | Earnings | 3.90% | £134.25 | £175.20 |

| 2021-22 | 0.50% | -1.0% | Fixed | 2.50% | £137.60 | £179.60 |

| 2022-23 | 3.10% | 8.60% | CPI | 3.10% | £141.85 | £185.15 |

| 2023-24 | 10.10% | 5.50% | CPI | 10.10% | £156.20 | £203.85 |

| 2024-25 | 6.40% | 8.50% | Earnings | 8.50% | £169.50 | £221.20 |

| 2025-26 | 1.70% | 4.10% | Earnings | 4.10% | £176.75 | £230.25 |

| 2026-27 | 3.80% | 4.80% | Earnings | 4.80% | £184.90 | £241.30 |

*2022-23 triple lock suspended due to significant growth in earnings in 2021 which was partially driven by the unwinding of the Government furlough scheme.

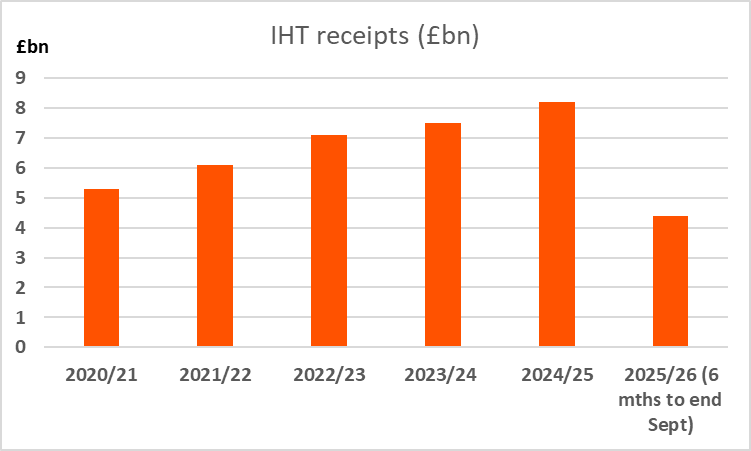

HMRC today announced the latest Inheritance Tax (IHT) receipts, within its wider tax receipts document > HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

- IHT receipts for the six months April to September 2025 are £4.4bn which is £0.1bn higher than the same period last year. This suggests the full year receipts may be approximately £8.8bn (£8.2bn in 2024/25)

- This continues the strong upward trajectory over the last few years (see graph and table immediately below)

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

| Tax year | IHT receipts (£bn) |

|---|---|

| 2020/21 | 5.3 |

| 2021/22 | 6.1 |

| 2022/23 | 7.1 |

| 2023/24 | 7.5 |

| 2024/25 | 8.2 |

| 2025/26 (6 months) | 4.4 |

Andrew Tully, Technical Services Director at Nucleus said:

"IHT receipts have grown by more than 50% over the last five years, a trend that is predicted to continue and accelerate. This is due to the freezing of nil rate bands until April 2030, rising UK property values, and planned reductions to agricultural and business reliefs from April 2026.

The Government is also proceeding with its plans to include pensions within IHT from 6 April 2027. This will deliver poor outcomes for customers, beneficiaries, personal representatives, the industry, and HMRC. But it will drive further strong growth in IHT receipts after 2027.

There is still time for the Government to consider alternative options which increase its tax take on wealthier people passing on pension wealth, while avoiding the numerous problems created by bringing pensions into IHT. However, it’s looking increasingly likely it will stubbornly stick with its current complex proposals.

Taken together all of this is likely to make IHT a more relevant issue for many more families within the next five years. Advisers can help clients mitigate these taxes by setting up trusts and making use of gift allowances and the spousal exemption.”

The FCA has released its retirement income data covering 2024/25 > Retirement income market data 2024/25 | FCA

This highlights a number of trends in the retirement market:

- The overall value of money being withdrawn from pension pots increased to £70,876m in 2024/25 from £52,152m in 2023/24. A very significant increase of 35.9%. This is likely to reflect more people taking tax-free lump sums in advance of the October 2024 budget, as well as people withdrawing more income as a result of the Government’s intention to include pensions within IHT from April 2027. (The number of people moving into drawdown and just taking TFC was 211,121 up from 163,582 in 2023/24).

- The number of pension plans accessed for the first time has also increased again. This year’s figure of 961,575 is 8.6% higher than last year.

- Sales of drawdown policies saw the biggest increase from 278,977 in 2023/24 to 349,992 in 2024/25, a 25.5% increase. The number of people taking advice when entering drawdown has edged down slightly from 46% last year to 45% this year. A further 12% took guidance with the remaining 43% taking neither advice nor guidance.

- The number of people taking 8% or higher withdrawals from their pension decreased slightly.

- The number of transfers out of defined benefit schemes continues to decline. In 2024/25, 6,418 took place. This is down on last year’s figure of 7,181 and a fraction of the 56,990 which transferred in 2018/19.

- The number of annuity sales has risen by 7.88% but as a percentage of the overall number of customers accessing their pension it has remained constant at 9%. The split of how people first accessed their pensions is in table below.

| Annuities | Drawdown | UFPLS | Encashments | |

|---|---|---|---|---|

| 2018/19 | 73,977 11% | 194,158 30% | 26,737 4% | 357,122 55% |

| 2019/20 | 69,534 10% | 197,118 29% | 31,664 5% | 375,664 56% |

| 2020/21 | 60,383 10% | 165,988 28% | 28,305 5% | 341,404 57% |

| 2021/22 | 68,514 10% | 205,641 29% | 36,271 5% | 395,235 56% |

| 2022/23 | 59,163 8% | 218,183 29% | 41,578 6% | 420,728 57% |

| 2023/24 | 82,061 9% | 278,977 32% | 54,694 6% | 469,723 53% |

| 2024/25 | 88,430 9% | 349,992 36% | 60,993 6% | 462,160 48% |

Number of pension plans accessed for the first time by method of access

Andrew Tully, Technical Services Director at Nucleus said:

‘The increase in the number of people accessing their pension is likely to reflect the Government’s moves to include pensions within IHT, and wider rumours around the future of the tax-free lump sum. This has caused many people to access tax-free cash and income, potentially to gift to family or shelter from IHT. It’s a reminder that ongoing policy changes drive poor customer outcomes and we ideally need stable long-term savings policy.

Drawdown remains the key retirement solution as it gives the flexibility to cope with changing needs in retirement. Given the ongoing freezing of the tax thresholds, being able to vary income to ensure it is taken as tax efficiently as possible is a key benefit.

However, the number of people accessing drawdown without taking advice or guidance is concerning. The complexity of retirement planning can’t be overstated. People approaching or thinking about retirement income need informed, impartial input which considers their personal circumstances. As well as the many product, technical and tax considerations. That’s why regulated financial advice is so important.

The increase in annuity sales isn’t a surprise given the significantly higher rates on offer, but it remains used by a relatively small number of retirees. Blending drawdown with a guaranteed income may give a better outcome than solely using an annuity.

And the continuing drop in transfers from defined benefit schemes is no surprise given the regulatory focus of the last five years, increase in PI costs and the relatively poor transfer values currently being offered.'

The ONS today confirmed the increase in average weekly earnings for the period to July 2025 was 4.7%

Average weekly earnings in Great Britain - Office for National Statistics

This is one of the elements of the triple lock, the highest of which drives the increase to the state pension from April 2026.

- The triple lock means state pensions increase by the highest of inflation, earnings and 2.5%

- The CPI figure which is used (Inflation for the year to September 2025) will be announced in October. It was 3.8% for the year to July (an updated number for August will be announced tomorrow)

- This means the increase in earnings is likely to be the highest element and therefore be used to determine the increase in state benefits

- While the headline state pension increases by the triple lock, other parts of the state pension such as SERPS/S2P, the graduated pension, protected payments and benefits for deferring, will go up by CPI.

The new state pensions from April 2026

- If the state pension increase was driven by this increase in earnings, the headline single tier state pension from April 2026 would be £241.05 a week, up from the current £230.25 a week

- The maximum basic state pension paid to those who reached state pension age before 6 April 2016 is currently £176.45 a week and it would increase to £184.75 a week

- The personal allowance remains frozen at £12,570 until April 2028. This means more pensioners will be liable to tax solely as a result of their state pension

- While these are the headline rates many people receive less

Andrew Tully, Technical Services Director at Nucleus said:

'It looks like we will get another relatively substantial increase to the state pension from April 2026 which will be a welcome boost to many pensioners. However it means many more will pay income tax solely as a result of their state pension given the ongoing freeze to the personal allowance, and Government will need to consider the best process to easily allow these people to pay tax.

While the headline state pension increases by the triple lock, other parts of the state pension such as SERPS/S2P, the graduated pension, protected payments, and benefits for deferring, will go up by CPI which may be lower than earnings.

The Government has announced a review of the state pension age which will consider if and when state pension age moves to 68 and beyond. However rather than focus solely on state pension age, we need to consider the future of our state pension system as a whole. As well as state pension ages, this wider debate should consider a suitable level of state benefit, the future of the triple lock, differing life expectancy across the UK, and support for those below state pension age who aren’t able to work.'

The history of the triple lock over the last ten years

| Year | CPI | Average earnings | Index used | Triple lock | Basic State Pension (individual) | New State Pension |

|---|---|---|---|---|---|---|

| % increase | £ per week | £ per week | ||||

| 2016-17 | -0.10% | 2.90% | Earnings | 2.90% | £119.30 | £155.65 |

| 2017-18 | 1.00% | 2.40% | Fixed 2.5% | 2.50% | £122.30 | £159.45 |

| 2018-19 | 3.00% | 2.20% | CPI | 3.00% | £125.95 | £164.35 |

| 2019-20 | 2.40% | 2.60% | Earnings | 2.60% | £129.20 | £168.60 |

| 2020-21 | 1.70% | 3.90% | Earnings | 3.90% | £134.25 | £175.20 |

| 2021-22 | 0.50% | -1.0% | Fixed 2.5% | 2.50% | £137.60 | £179.60 |

| 2022-23* | 3.10% | 8.60% | CPI | 3.10% | £141.85 | £185.15 |

| 2023-24 | 10.10% | 5.50% | CPI | 10.10% | £156.20 | £203.85 |

| 2024-25 | 6.40% | 8.50% | Earnings | 8.50% | £169.50 | £221.20 |

| 2025-26 | 1.70% | 4.10% | Earnings | 4.10% | £176,45 | £230.25 |

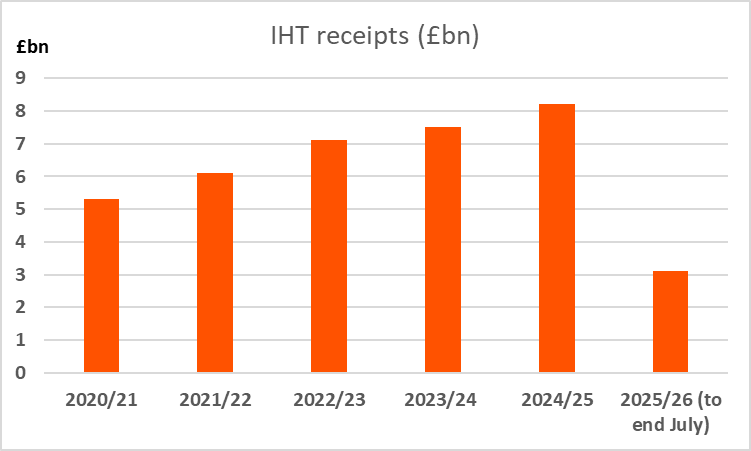

HMRC today announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document > HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

IHT receipts for April to July 2025 are £3.1bn which is £0.2bn higher than the same period last year.

This continues the strong upward trajectory over the last few years (see graph and table immediately below.

The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

Tax year | IHT receipts (£bn) |

|---|---|

| 2020/21 | 5.3 |

| 2021/22 | 6.1 |

| 2022/23 | 7.1 |

| 2023/24 | 7.5 |

| 2024/25 | 8.2 |

2025/26 (4 months) | 3.1 |

Andrew Tully, Technical Services Director at Nucleus said:

"IHT receipts have increased more than 50% over the past five years with the OBR suggesting significant increases will continue over the next few years. That upward trend is continuing in the 2025/26 tax year. Receipts will increase further in the years to come due to recent policy changes including limits to agricultural and business reliefs and extending the freeze in IHT nil-rate bands to 2029/30, as well as ongoing increases to property prices across the UK.

The Government has also said it will proceed with its plans to include pensions within the estate for deaths after 6 April 2027. This will deliver poor outcomes for customers, beneficiaries, personal representatives, the industry, and HMRC. But it will drive further strong growth in IHT receipts after 2027.

There is still time for the Government to consider alternative options which increase its tax take on wealthier people passing on pension wealth, while avoiding the numerous problems created by bringing pensions into IHT. However, it’s looking increasingly likely it will stubbornly stick with its current complex proposals.

Taken together all of this is likely to make IHT a more relevant issue for many more families within the next five years. Advisers can help clients mitigate these taxes by setting up trusts and making use of gift allowances and the spousal exemption.”

The Department for Work and Pensions has announced it will set up a Pensions Commission which will look to make recommendations by 2027.

Nucleus has made several calls for the introduction of a Pensions Commission including an open letter to the Pensions Minister Torsten Bell in March this year (copy attached).

Andrew Tully, Technical Services Director at Nucleus said:

"Nucleus has made numerous calls for the introduction of a Pensions Commission, and it is a welcome development that the Government has decided it will set one up. It’s never been clearer that the UK public needs to start planning and saving for later life much, much earlier. But they need support from a pensions system that is consistent, stable and encourages long-term saving.

Automatic enrolment was a recommendation by a Pensions Commission reporting in 2004 and 2005, which has been a great step forward in encouraging more people to save for their retirement. However more needs to be done and we firmly believe that establishing a new Pensions Commission could again make balanced recommendations to encourage long-term savings, while promoting greater consistency in pension and savings rules."

Nucleus Retirement Confidence Index 2024

The Nucleus UK Retirement Confidence Index via YouGov, seeks to assess whether people have confidence they’ll be able to retire comfortably.

Our research clearly – and predictably - highlights those with defined benefit (DB) pensions are most confident. But we know DB is in sharp decline following most private schemes being closed to new joiners or bought out over the last twenty years, and there’s a rapidly growing reliance on defined contribution (DC) pension provision. We’ve evidenced that those relying solely on DC pensions are much less confident of their financial future.

Automatic enrolment is one key policy that has been a huge success in getting more people to save for their retirement, within the DC environment. This policy was proposed by an Independent Pensions Commission reporting in 2004 and 2005. Perhaps at least partly because it was proposed by an independent body, the introduction of auto-enrolment had from outset, and continues to have, wide cross-political party support.

While auto-enrolment has successfully created millions of new savers, it’s widely agreed that people are not saving anywhere near enough. The complexity of retirement and tax planning involved in turning a pot of money into a retirement income can’t be overstated. Added to that people need to decide when and how to use money held in other assets such as ISAs, investments and property, alongside pension savings.

A key area highlighted within our research is the desire for pension savers to have trust in the long-term savings market and have a stable tax and policy environment. Pensions are a long-term investment, and over many years, under various different governments, there have been constant changes and tinkering to the pension tax rules which deter people from engaging with the pension system and negatively affecting their confidence.

A copy of the full report is available here > Retirement Confidence Index

The Government confirmed today it is pushing ahead with plans to include pensions within Inheritance Tax from April 2027 > Inheritance Tax on unused pension funds and death benefits - GOV.UK

The Government believes this will raise around £1.5bn a year by 2029/30.

It has made a couple of changes from its original proposals which it consulted on (the consultation closed in January). These are:

- personal representatives, rather pension scheme administrators, will be liable for reporting and paying any Inheritance Tax due.

- death in service benefits payable from a registered pension scheme will remain out of scope of inheritance tax (these benefits are usually a lump sum paid to family equivalent to a multiple of an employee’s salary if they die while still working for an employer).

While these amendments are helpful to some degree it is disappointing that the Government is proceeding with using IHT rather than an alternative option. A report by TISA and Oxford Economics launched last week, which was co-sponsored by Nucleus, (copy attached) shows there are alternative options which achieve the Government’s policy objective and raise similar amounts of tax. But without all of the horrible complexity created by including pensions within the IHT environment.

Andrew Tully, Technical Services Director at Nucleus Financial said:

“Including pensions within the IHT environment will deliver poor outcomes for customers, beneficiaries, personal representatives, the industry, and HMRC. This complex process will cause bereaved families confusion and stress at a difficult time and doesn’t fit well with the support firms may want to provide people who are likely to be vulnerable following the death of a loved one.

While it is welcome that HMRC has made some amendments to its proposals, it is very disappointing it has not listened to very strong views that using IHT is not the best option. Recent analysis has proved there are other options which allow the Government to increase its tax take on wealthier people passing on pension wealth, while avoiding the numerous problems created by bringing pensions into IHT.”

HMRC today announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document > HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

- IHT receipts for April to December 2024 are £6.3bn, which is £0.6bn higher than the same period last year.

- This continues the strong upward trajectory over the last few years.

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

The Office for Budget Responsibility expect these numbers to continue rising as shown in the table below:

| Year | 2023/2024 | Expected 2024/2025 | Projected 2029/2030 |

|---|---|---|---|

| Total £ | 7.4bn | 8.3bn | 13.9bn |

| Increase | £0.9bn | £5.6bn |

Andrew Tully, Technical Services Director at Nucleus said:

"IHT receipts continue to grow strongly with the OBR suggesting ongoing increases will continue over the next few years. OBR’s £8.3bn estimate for full year 2024/25 would be a 10.7% increase from last year. It suggests receipts will increase further in the years to come due to recent policy changes including limits to agricultural and business reliefs and extending the freeze in nil-rate bands to 2029/30. The Government’s consultation to include pensions within the estate for IHT purposes from April 2027 closes today and if that change proceeds it will help drive this further growth. OBR predict receipts will be nearly £14bn by 2029/30, around double the amount raised in 2022/23.

Advisers can help clients mitigate these taxes by setting up trusts and making use of gift allowances and the spousal exemption. Additionally, equalising assets between spouses & civil partners and making use of the “no gain no loss” disposal could mean all exemptions can be utilised and household income increased if there is a disparity in the rates of tax each spouse pays.”

HMRC today announced the latest Inheritance Tax (IHT) and Capital Gains Tax (CGT) receipts, within their wider tax receipts document > HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

Capital Gains Tax

The CGT figures are included within one figure representing Income Tax, CGT and National Insurance which are £226.8 bn, £6.2 bn higher than the same period last year.

Basic rate income taxpayers are typically subject to lower CGT rates: 10% on gains from most assets and 18% on residential property

For trusts, and for individuals who are subject to higher or additional rates of tax, the higher rates of CGT apply. 20% for most assets and 24% on residential property

Inheritance Tax

IHT receipts for April to September 2024 are £4.3 bn, which is £0.4 bn higher than the same period last year.

This continues the strong upward trajectory over the last few years

The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

Andrew Tully, Technical Services Director at Nucleus said:

“While CGT is not individually specified within these figures, and the majority is paid in January as part of self-assessment, anecdotal evidence suggests more people are disposing of assets and realising gains in advance of the Budget on 30 October. CGT receipts are therefore likely to increase sharply this year. Growth in IHT receipts continues its upward trajectory following record highs in the last few years.

There are many rumours suggesting changes to both CGT and IHT within the forthcoming Budget. For IHT, changes could be made such as scrapping or updating the rules on agricultural land and business relief. Currently, a person can claim up to 100% relief on the inheritance of agricultural land if it is being actively farmed. This could be reduced, or certain limitations placed on the maximum value of the relief. Changes could also be made to the IHT benefits of holding shares on the Alternative Investment Market (AIM). AIM shares need to qualify for Business Property Relief and be held for more than two years at the time of death to qualify for IHT exemption. However, this may run contrary to the desire to increase investment in UK businesses, to drive further growth.

Advisers can help clients mitigate these taxes by setting up trusts, making use of gift allowances, spousal exemption and using a pension to pass on wealth to family in a tax efficient way. Additionally, equalising assets between spouses & civil partners and making use of the “no gain no loss” disposal could mean all exemptions can be utilised and household income increased if there is a disparity in the rates of tax each spouse pays. Alternatively, people could hold assets within a tax-efficient wrapper such as an ISA, pension or bond.”

HMRC announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK

Total HMRC tax receipts for the April to May 2024 are £132.8 billion, which is £3.6 billion higher than last year.

Receipts were higher from Income Tax, Capital Gains Tax and National Insurance Contributions (NICs), business taxes and stamp taxes.

- Receipts were lower from VAT and fuel duty.

Inheritance Tax

- IHT receipts for April & May 2024 are £1.4 billion, which is £0.2 billion higher than the same period last year.

Andrew Tully, Technical Services Director at Nucleus said:

“These figures continue the strong upward trajectory in IHT receipts over the last few years. The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules. Both are currently intended to be frozen until 2028. Given all of this the need for expert financial planning remains crucial.

“Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

HMRC today announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document: HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK.

- Total HMRC tax receipts for the 2023/24 tax year are £827.7 billion, which is £39.1 billion higher than last year

- Receipts were higher from Income Tax, Capital Gains Tax and National Insurance Contributions (NICs), business taxes and VAT

- Receipts were lower from stamp taxes and Tobacco.

Inheritance Tax

- IHT receipts for 2023/24 are a new record £7.5 billion, which is £0.4 billion higher than last year.

- This continues the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said: “These are record IHT receipts following on from previous record highs in each of the last two years. The Office of Budget Responsibility predicts the IHT take will be £9.7bn in 2028/29 which means the impact of this tax is set to continue growing strongly.

Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

The FCA today released its retirement income data for 2022/23 (Retirement income market data 2022/23 | FCA).

A summary of the data is detailed in the table below.

| 2021/22 | 2022/23 | |||

|---|---|---|---|---|

| Number of plans | Monetary value (£000) | Number of plans | Monetary value (£000) | |

| Total pots accessed for first time | 705,661 | 45,638,188 | 739,535 | 43,199,189 |

| Annuities purchased | 60,574 | 5,153,150 | 59,163 | 4,060,947 |

| New drawdown policies entered into and not fully withdrawn | 205,641 | 31,794,619 | 218,074 | 29,867,353 |

| Pots where first partial UFPLS payment taken and not fully withdrawn | 36,271 | 3,693,212 | 41,571 | 4,002,707 |

| Full cash withdrawals from pots being accessed for first time* | 395,235 | 4,997,207 | 420,727 | 5,268,182 |

It shows:

- Slightly more pots (4.9% higher) were accessed for the first time in 2022/23 than in 2021/22 (739,535 vs 705,661).

- However the monetary value was down, suggesting more people took out slightly lower value withdrawals.

- The percentage of customers using the different solutions has remained broadly constant.

- In monetary terms the majority of funds go into drawdown.

- In customer numbers most take full cash withdrawals.

- Sales of annuities fell slightly, which is probably a surprise given rates have generally been good.

- The number of DB transfers continued to fall.

Andrew Tully, Technical Services Director at Nucleus Financial, said: “The effects of the cost-of-living crisis will unfortunately be felt for years to come, so it’s no surprise to see greater numbers of people making withdrawals from pensions than in the previous tax year. We have recently conducted some consumer research which revealed that 74% of UK adults cite ‘affordability’ as one of the issues that negatively affects their retirement confidence. That figure rises to 81% of those aged between 45-54. Many people need to access their pension while still working to pay unexpected bills or help wider family.

“Drawdown will remain the key retirement solution for many as it gives the flexibility to cope with changing needs in retirement. Given the ongoing freezing of the tax thresholds, being able to vary income to ensure it is taken as tax efficiently as possible is a key benefit. The increase in advised annuity sales isn’t a surprise given the significantly higher rates. But blending drawdown with a guaranteed income may give a better outcome than solely using an annuity.

“Given the range of retirement options available, it is important consumers get good advice at the point they first access their pensions savings and on an ongoing basis to work out the best options for their individual circumstances.

“Drawdown advice can be complex, covering areas such as the sustainability over a long time period; the ideal investment options; and tax advice, including how to pass on wealth efficiently to family. Advisers need to be clearly documenting their advice as that is one of the areas the FCA focused on during its retirement income advice review.”

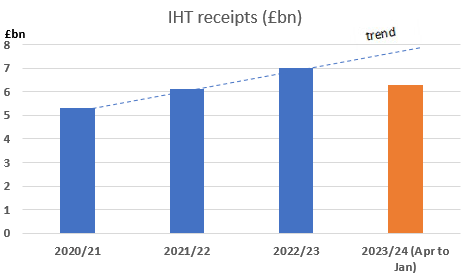

HMRC has announced the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk)

- Total HMRC tax receipts for April 2023 to January 2024 are £695.1 billion, which is £33.6 billion higher than the same period last year.

- IHT receipts for April 2023 to January 2024 are £6.3 billion, which is £0.4 billion higher than the same period last year

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the Budget on 6 March

- However, even if IHT were scrapped it is possible some tax would apply to assets passed on after death – for example, Capital Gains Tax.

- The Labour party has said that if it wins the election it would reverse any abolition of IHT.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said: “It looks set to be another record-breaking year for IHT receipts. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions, given this year’s receipt are on track for around £8bn.

There are rumours the Government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial. Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”