The Nucleus UK Retirement Confidence Index 2025

What’s driving retirement confidence down in the UK? Client insights you won’t want to miss.

Retirement is one of the most significant milestones in life, yet for many people across the UK it carries as much uncertainty as it does anticipation. Our Retirement Confidence Index offers a unique, in-depth look at attitudes, expectations, and concerns surrounding retirement across the UK at different life stages.

Whether you're refining your client communications or shaping your advice proposition, these insights can help you stay ahead of your clients' expectations and build deeper trust.

Surveying over 4,300 UK adults, our index shines a light on the factors affecting retirement confidence.

Our inaugural retirement confidence survey in 2023, was the first of its kind and led the charge to record how prepared we are in the UK for retirement.

Your clients' perspectives

With lower awareness and higher concerns, a staggering 74% of respondents aren’t confident they’ll have enough money to live comfortably for the rest of their lives. We took to the streets to find out what the public had to say...

Our 2025 report highlights

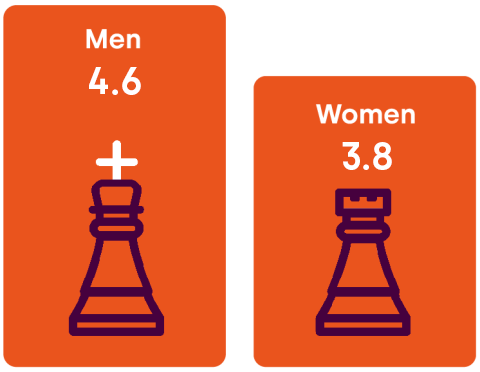

Retirement confidence from the 2025 Nucleus Retirement Confidence Index score has dropped to 4.2 out of 10 with a negative outlook.

The need to start planning and saving for retirement as early as possible couldn’t be clearer.

Just under half of UK adults are worried about pensions being included in IHT from April 2027.

Just under 7 in 10 UK adults believe early lessons in money, pensions, and investing would’ve boosted their confidence in retirement.

Only 16% have confidence that the Independent Pensions Committee will make a meaningful positive difference on retirement planning.

Majority of UK adults think they’ll need £20-30k per year to have a comfortable retirement, less than the Pensions UK figure of just under £44k.

Adults 55 and over feel the most confident of all age groups, with a greater decline in confidence for 18–34 year-olds.

Download the report

In the 2025 Nucleus UK Retirement Confidence Index you’ll find the full analysis of our consumer and advice professional research and a comparison of how these results stack up against last year's.

“The road to a financially secure retirement is paved by making the right choices at the right times.”

Andrew Tully

Technical Services Director

Sign up for a first look at the Autumn Budget changes

Register for our Autumn Budget webinar and find out how the changes will affect your clients – plus hear more about our recent Retirement Confidence Index.