Transfer investments to us

If you have investments held with other providers, it may be possible to transfer them to the James Hay Modular iPlan.

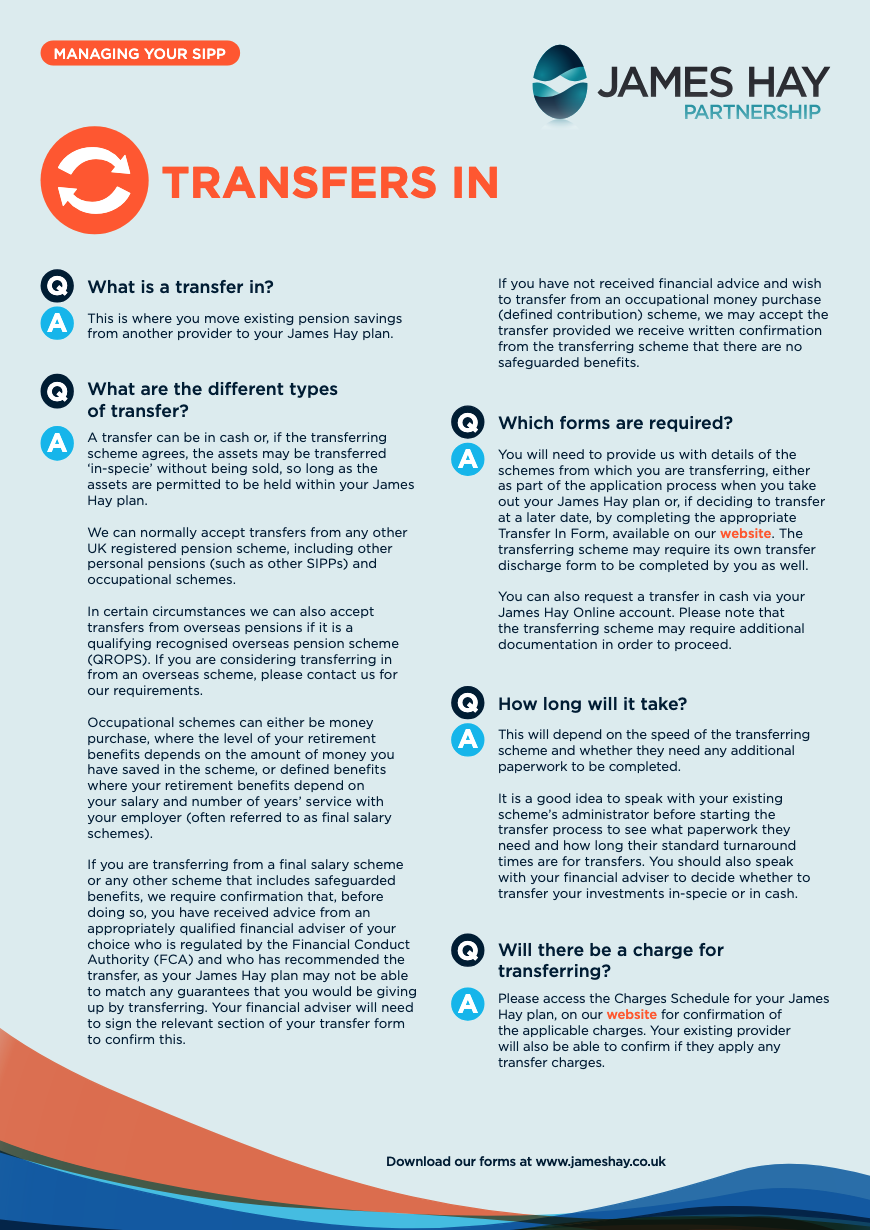

Transferring pensions to us – We can accept transfers into the Modular iSIPP from other registered pension schemes, including Qualifying Recognised Overseas Pension Schemes (QROPS) and pensions you have already taken an income from. Transfers can be made as cash or as existing investments (an 'in-specie' transfer), provided they can be supported by James Hay.

It is very important to ensure that a pension transfer is appropriate and that you won’t lose any guaranteed income or safeguarded benefits by transferring out. We strongly suggest that you seek financial advice in all instances, and there are certain types of pension transfer that we can only accept if recommended by a regulated adviser.

Transferring ISAs to us

Individual Savings Accounts (ISAs) taken out with other providers can be moved into the Modular ISA without affecting your current year’s ISA allowance, providing you make a formal ISA transfer request to us.

Transferring other investments to us

Funds and other investments not held in an ISA or SIPP may also be transferred to us using the Modular GIA. You can transfer their cash value or re-register existing investments provided they can be supported by James Hay. See the Modular GIA Permitted Investments List for further details.

Please note: you must set up a Modular iSIPP before you can apply for a Modular ISA or Modular GIA.

How to transfer a pension to your James Hay SIPP

There are two options for making a transfer in if your SIPP is already open:

You can request a cash transfer from the Portfolio screen of your James Hay Online account.

Alternatively you can submit a completed 'SIPP Cash Transfer In Form' or 'SIPP In-specie Transfer Form' found on the Literature pages of our website, along with any supporting documentation, such as discharge forms.

Yes - If you have a defined benefit (occupational final salary) pension or defined contribution pension which includes safeguarded benefits, you must have received advice from a regulated financial adviser, who is recommending that you proceed with the transfer. We do not accept transfers where you are deemed an ‘insistent client’, which under the Financial Conduct Authority’s (FCA) guidance is where an adviser will transact business for you against their advice, if you insist.

It is important to be aware that you are likely to be worse off when transferring from a defined benefit scheme to a defined contribution scheme, such as a SIPP, even if you are being offered an incentive to do so. You can read more about transferring a defined benefit scheme on the MoneyHelper website.

The FCA attaches significant importance to you understanding the impact of surrendering long term pension rights, and emphasises that the financial adviser must evidence that your financial position will be enhanced by transferring.

Your financial adviser will need to:

- Be regulated by the FCA

- Have the relevant FCA permission to advise on the transfer of a defined benefit scheme and be giving explicit advice recommending the transfer

- Complete our Confirmation of Advice to Transfer Pension Fund form, which must be submitted to us on the adviser’s company letterhead. Alternatively, your adviser can complete and sign the relevant sections of our Transfer In Forms, which are available in our literature library.

This will depend on the speed of the transferring scheme, whether they need any additional paperwork to be completed, and the complexity of the assets held. You may wish to to speak with your existing scheme’s administrator before starting the transfer process to see what paperwork they need and how long their standard turnaround times are for transfers.

You should also speak with your financial adviser to decide whether to transfer your investments in-specie or in cash.

You need to be aware of pension scams, as there are people who seek to profit financially from recommending that you transfer pensions. The greater flexibility introduced by the Government has provided an opportunity for criminals to take advantage of investors, and you should be particularly wary of anyone who is recommending or encouraging you to transfer if they are not your FCA regulated financial adviser.

You can read on our 'Avoiding pension scams' page.