The recently released 2022 Client Experience Report shares valuable insight from more than 250,000 clients’ feedback on VouchedFor.

One important takeaway for advice firms is that while most clients are happy, many firms are missing out on huge revenue opportunities from prospective clients.

The report highlighted that 52% of prospects who leave a 5* ‘First Impression’ review on VouchedFor intend to become a client. Unfortunately, this intent drops to less than half (25%) if they leave a 4* review.

The good news is that the report has also uncovered the factors that make prospects more likely to become clients.

The Consumer Duty has an important role to play

Firms that are winning appear to be doing more than simply box-ticking when making changes in readiness for the Consumer Duty.

While the Consumer Duty requires firms to understand the needs of consumers at every step of the service lifecycle, the majority of firms are failing to capture enough relevant information about prospective clients who fail to become clients.

This missed opportunity is potentially huge.

Meanwhile, winning firms are embracing the incoming changes and actively working to enhance their client experience.

Enhancing service for prospective clients could increase conversion by more than 50%

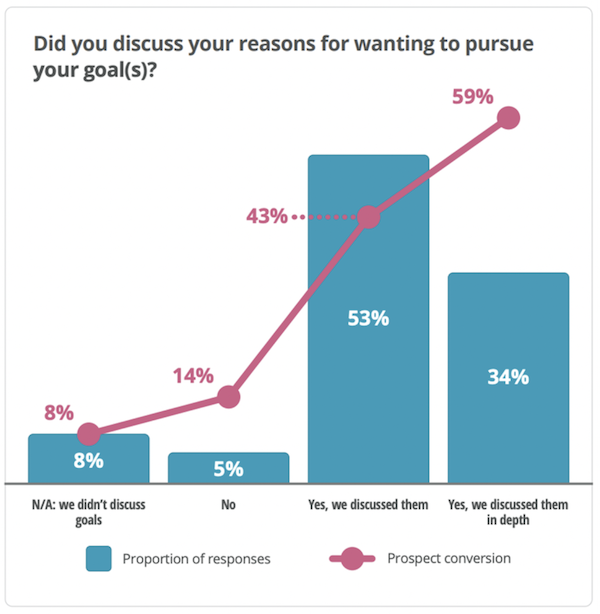

59% of prospective clients who said they had an in-depth discussion about their reasons for pursuing their goals became a client.

Meanwhile, 43% of prospects whose motivations were discussed, but not 'in depth', converted to clients.

Where goals or motivations were not discussed at all, the average conversion falls below 14%.

(Source: ProfessionalAdviser: The Client Experience Report)

3 simple ways to make prospects more likely to become clients

-

Make sure the focus of the conversation is on them, not you

As the figures outlined above show, gaining a full understanding of prospective clients’ needs can make a significant difference to the eventual outcome.

The report states that: “The real clincher when it comes to converting prospects is the first meeting […] Its importance really cannot be overstated.”

While it can be tempting to lead with a pitch about “What I can do for you” when you’re trying to impress prospective clients, the data shows that you’ll do better by taking the time to let them talk.

By listening and truly understanding the potential client’s needs and motivations, you’re more likely to turn them from a prospect into a client.

-

Understand and address the customers’ needs

Once you have gained more understanding about a prospect’s motivations, use the initial meeting to impart useful knowledge and help them improve their own understanding around those topics that matter to them most.

Delivering value in this way is more likely to leave prospective customers with a positive impression.

Don’t underestimate the importance of sharing your knowledge: only 4% of prospective clients who didn’t learn much from the initial meeting with an adviser intend to become clients.

-

Leave a lasting impression, even if the client isn’t a viable prospect for you right now

Always remember that, even if prospects are not viable clients right now, they may discuss their experience with others. And it’s also likely that their circumstances could change in the future.

By ensuring that every prospect has a great initial experience of you and/or your firm, the more likely they will be to talk about you in glowing terms and keep you front of mind down the line.

Helping everyone you meet will enhance your reputation, that of the profession, and will almost certainly prove good for your business in the long run.

The results of doing all this are clear to see…

Prospects who felt comfortable being open, had an in-depth discussion on their motivations, and had a clear understanding of how the adviser would help them had a conversion rate of 71%.

And the work doesn’t stop once someone becomes a client.

Existing clients are your bread and butter, so it makes sense that you want to work hard to keep them satisfied.

But it is likely to take more than a client being simply satisfied with your service before they have the confidence to recommend you to other people. And the data backs this up.

While most clients (99%) say they would consider recommending their adviser, only a third (37%) have recommended their adviser more than once in the last 12 months.

On average, the data shows that financial advisers receive 1.33 recommendations client/year.

This shows that it's important to keep up the momentum with clients so don't forget to maintain an ongoing dialogue with them - for example through a monthly newsletter - to remind them of the value you provide, and to give them an easy way of sharing that value with others.