Media hub

1 December 2025

Foster Denovo extends platform partnership with Third Financial

Wealth manager Foster Denovo has extended its strategic partnership with Third Financial, part of the Nucleus group, signing an exclusive deal for a bespoke Adviser-as-a-Platform (AaaP) solution.

Read our latest press releases

25 November 2025

Pre-Budget speculation and policy tinkering damaging consumer confidence in retirement says Nucleus

Unhelpful pre-Budget speculation including possible changes to tax-free cash and political tinkering with rules around pensions has damaged retirement confidence among savers...

12 November 2025

Retirement confidence hits new low ahead of budget as calls grow for policy stability and early financial education

The third annual UK Retirement Confidence Index from Nucleus shows only one in four UK adults are confident they’ll have enough money to live comfortably in retirement.

6 November 2025

Verso Asset Management to transfer custody to Third Financial in new five-year deal

Verso has extended its strategic partnership with Nucleus, transferring the custodial operations of its investment management arm to Third Financial under an initial five-year deal.

Archive

Wealth manager Foster Denovo has extended its strategic partnership with Third Financial, part of the Nucleus group, signing an exclusive deal for a bespoke Adviser-as-a-Platform (AaaP) solution.

AaaP is when the proposition to clients, along with parts of the service usually provided by the platform, are branded and controlled by the advisory firm. The model enables firms to take greater control of the products offered, customer experience as well as more of the value chain.

Third Financial and Foster Denovo have worked collaboratively on the customised platform transformation project which is designed to meet the complex needs of advisers and their teams, enabling them to service clients even more effectively. The new investment platform also features a two-way integration with the back-office system.

The client experience will be further enhanced through the launch of a new Clearview-branded mobile app, giving clients at the UK-wide financial advisory group an even more intuitive way of engaging with their investments.

The two firms have a long history of working together, with more than £1 billion of client assets already administered on the platform, powered by Third Financial’s proprietary Tercero software.

Foster Denovo Chief Operating Officer Helen Lovett said: “Like many in our sector, we had evolved our services across a number of different retail investment platforms over time. We always strive to create a more unified experience for our clients which is why we took the strategic decision to develop our own platform.

“Partnering with Third Financial to deliver this is a big step forward. They’ve become a strong, long-term partner, providing the support we need to deliver an exceptional service to our clients and to continue to drive forward our growth strategy.”

Chris Williams, Managing Director, Third Financial at Nucleus, added: “It’s a reflection of the depth of our relationship that Foster Denovo has extended their partnership with us. Their new investment platform, powered by Third Financial, is a customised solution built on our market leading technology which will enable them to offer a branded and tailored service to their clients.

“The scale and unrivalled expertise we have within the group will support Helen and her team as they continue to integrate their recent acquisitions and help drive their future growth.

“We already power some of the industry’s leading consolidators such as Titan, Verso and Radiant, plus 60 investment managers. Our combination of market leading technology, personalised service and financial strength is setting us apart in the market.”

Nucleus acquired Third Financial last year. The group offers the broadest range of products, services and software options that enable large advisory firms and consolidators, investment managers and institutions, to take greater control of their platform propositions.

Enquiries:

Nucleus

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Foster Denovo

E: fosterdenovo@mrm-london.com

T: 07793 564 351

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,200 financial advisory firms, the group now administers over £107bn of investments on behalf of over 250,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

About Foster Denovo

Foster Denovo is a multi-award-winning national firm of financial advisers with 13 offices across the UK. Its partners provide specialist financial advice, services and investment solutions to individuals and their families, businesses, employers and charities.

Advice for individual clients covers the full range of advisory areas, including financial planning, wealth management, retirement solutions, at retirement advice, estate planning, mortgages and protection.

Foster Denovo is part of the Foster Denovo Group.

Unhelpful pre-Budget speculation including possible changes to tax-free cash and political tinkering with rules around pensions has damaged retirement confidence among savers, Nucleus has said, making it far more difficult for savers to plan ahead with any certainty for the long term.

Today’s adults are facing an increasingly challenging landscape when it comes to planning and investing for retirement, including contending with the news that pensions will be included as part of an individual’s estate for inheritance tax (IHT) planning purposes.

Savers have faced weeks of speculation around possible cuts to tax-free cash in the upcoming Autumn Budget. Even though changes to tax-free cash have now reportedly been ruled out by the Chancellor, the rumour will certainly have resulted in many people pulling money out of their retirement savings unnecessarily, potentially damaging their long-term retirement plans.

In its 2025 Retirement Confidence Index report, Nucleus found that the proposals around IHT and pensions may be driving unwanted and potentially damaging behaviour. With around 1 in 7 of younger/middle aged respondents (15% of those aged 25-34, 14% of 45-54) saying they are paying or will pay less into their pensions as a result.

The report found clear evidence that policy changes, uncertainty and speculation leads to self-destructive behaviours. People saving for retirement are being driven to make long-lasting decisions that cannot be reversed.

Another worrying statistic from Nucleus’ report is that only one in four UK adults (26%) are confident they will have enough money to live comfortably for the rest of their lives, down from the previous low of 34% in 2024.

Andrew Tully, Technical Services Director at Nucleus, said: “It’s a tough environment for pension savers today, and the last thing they need is to feel like they aren’t in control of their retirement savings planning because of government tinkering, uncontrolled speculation and changes to existing rules.

“Changes to pension tax-free cash withdrawals reportedly being off the table for this year’s budget is welcome news, but without a stable retirement framework the same damaging rumour will continue to drive behaviour ahead of future fiscal events. To help UK adults feel more confident about their financial futures, we need long-term planning in pensions. We cannot be in a position that sees savers make drastic changes to their retirement savings because of rumour and speculation, because they don’t trust that pensions will be left alone.”

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,200 financial advisory firms, the group now administers over £107bn of investments on behalf of over 250,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

EDITOR'S NOTES - all press releases should contain the following information:

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 4,359 adults. Fieldwork was undertaken between 9 - 10 September 2025. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

The third annual UK Retirement Confidence Index from Nucleus, the largest independent adviser platform group in the UK, shows only one in four UK adults are confident they’ll have enough money to live comfortably in retirement.

Other key findings include:

- Amidst all the speculation over the upcoming budget, retirement confidence in the UK has fallen to its lowest point since the survey began. Only 26% of adults confident they will have enough money to live comfortably for the rest of their lives (down from 34% last year).

- The overall Retirement Confidence Index score now stands at 4.2 out of 10, down from 4.6 in 2024 and 6.9 in 2023, continuing a worrying downward trend in confidence across all age and gender groups.

- The 45-54 and 35-44 age groups have the lowest confidence at 3.2 and 3.4 respectively. The next generation of retirees are less likely to have defined benefit savings to fall back on and haven’t benefited from auto-enrolment until later in their working lives. This confirms the need for prompt action.

- Confidence is highest among those receiving professional financial advice. UK adults who receive professional financial advice report a retirement confidence score of 5.5 out of 10 – well above the 4.2 national average – showing a strong link between planning, advice and long-term confidence.

The research, conducted by YouGov for Nucleus, surveyed 4,359 UK adults, evenly split between men and women. It reveals a growing sense of pessimism about retirement prospects, driven by the cost of living, low financial literacy, and frequent speculation about pension and savings rule changes.

Women’s confidence falls further behind men’s

The gender confidence gap has widened again this year. Men recorded an average confidence score of 4.6, compared with 3.8 for women. Nearly half of women (45%) said they do not currently contribute to a pension, compared to 40% of men.

Whilst defined contribution (DC) and workplace pension membership is broadly level between men and women (37% and 36% respectively), women are far less likely to have other forms of savings. Only 22% have a private pension compared to 30% of men, 25% have cash savings versus 35% of men, and 28% hold an ISA compared to 36% of men.

This underlines both the financial disadvantage women face and the urgent need for more targeted communication and support to close the gap in retirement preparedness.

Commenting on the research, Andrew Tully, Technical Services Director at Nucleus said: “The gender gap in retirement confidence is a clear warning sign. Women are saving less, have fewer financial products, and are less confident about their long-term prospects. We need more targeted communication, flexibility in saving options, and a concerted effort to make financial planning more inclusive so women aren’t left behind.”

Cost of living pressures continue to bite

The report found that 43% of UK adults do not contribute to a pension, with 41% citing the rising cost of living as the main barrier to saving more or anything into their workplace or private pension. Rent and mortgage payments (24%) and debt repayments (16%) were also major obstacles.

Those who are paying into a pension are often not saving enough. The most common contribution level is between 5% and 10% of income – largely reflecting auto-enrolment minimums – far below what is needed for a comfortable retirement.

Early education and access to advice seen as key to confidence

A striking 68% of respondents said they’d feel more confident about retirement if they’d learnt more about financial planning, pensions, and investing at an earlier age. Four in ten (42%) believe people should start planning in their 20s, a view shared across all age groups.

Confidence is also closely linked to engagement with advice. Those who have taken professional financial advice score significantly higher than those who rely on free guidance (4.4) or manage their own finances (4.9).

Andrew Tully continued: “Financial education needs to start early. Empowering people to understand pensions, investment and tax from a young age would make an enormous difference to future confidence. But it’s equally important that adults can access affordable, trusted advice to help them make informed decisions at key stages in life.”

Policy changes fuelling uncertainty

Confidence has also been shaken by changes and speculation around pensions and tax especially in the lead up to the budget. Nearly half (44%) of adults said they were worried about pensions being brought into scope for Inheritance Tax from April 2027, and three in five (59%) were concerned about possible cuts to tax-free pension lump sums.

Just 16% believe the new Independent Pensions Commission (IPC) will make a meaningful positive difference, highlighting a lack of awareness and faith in long-term policymaking.

State pension doubts add to uncertainty

The research also found widespread concern about the future of the state pension. More than half (54%) of UK adults believe it won’t exist in its current form within ten years, while a quarter (25%) think it may disappear altogether.

Understanding of how the system actually works also remains low. Almost half of respondents (44%) believe their National Insurance contributions go into a personal pot to fund their own pension.

Andrew Tully added: “The state pension remains the cornerstone of retirement income for millions, yet confidence in its future is collapsing. People deserve clarity and consistency. They need to know what they’ll receive and when. Without that certainty, it’s almost impossible to plan effectively for the rest of their lives.”

The call for stability

The 2025 Nucleus UK Retirement Confidence Index concludes that rebuilding trust will require a stable policy framework that removes pensions from short-term political cycles and stops using pensions as a political lever. We need instead to have clearer and well communicated longer-term goals.

Nucleus is urging policymakers to work with the IPC to take a long-term view and promote consistent, future-focused rules that encourage saving and planning.

Andrew Tully concluded: “We’re seeing a deep erosion of trust in the retirement system. Constant tinkering with pension rules makes long-term planning feel pointless. The IPC is a step in the right direction, but confidence won’t return until people believe the rules will remain stable. We need clear communication and a joined-up approach across pensions, housing and savings to give people the certainty they need to plan properly for the future.”

The full 2025 Nucleus UK Retirement Confidence Index can be viewed here: 2025 Nucleus UK Retirement Confidence Index

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £107bn of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Verso, the UK-based wealth management group, has extended its strategic partnership with Nucleus, transferring the custodial operations of its investment management arm to Third Financial under an initial five-year deal.

The deal grows the Nucleus group’s existing relationship with Verso, following the announcement it would be powering The Verso platform earlier this year. Over £250 million in assets under management is expected to be transferred over the next few months.

Verso Investment Management will become the third new client in recent months for Third Financial, following signings with City Asset Management and Titan Wealth. Third’s technology is now used by more than 60 firms.

Andrew Fay, Co-Founder and Director at Verso said: “We’re delighted to be extending our successful partnership with Third Financial so they will be our dedicated custody partner. With their deep knowledge and experience of the wealth management industry, the team at Third Financial continue to give us full confidence in their ability to provide a market-leading technology solution, with unwavering commitment to client service and innovation.

“Not only will this improve the experience for our advisers, it will also better support them in delivering excellent outcomes for their clients.”

Ricky Ali, Commercial Director at Third Financial added: “Over the past year we’ve been working with Verso to see how we could help meet their needs as they scale and grow. It’s a huge vote of confidence in our team that we've won the mandate as dedicated custody partner to Verso’s Investment Management.

“Having the financial strength and breadth of capability of the Nucleus group behind us makes a real difference to our conversations with ambitious, investment managers looking for a committed, long-term partner”.

“Our continued and sustained growth reflects our position as the first choice for investment managers and advisers seeking industry leading technology-led solutions, and a focus on great customer service.”

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £101bn of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

We were seeking a proven technology-led platform partner who could help us to deliver the highest standard of service to our clients. The bespoke solution that we’ve developed together means we’re able to leverage Nucleus’ technology and platform expertise to create a scalable platform that is key to our growth ambitions.

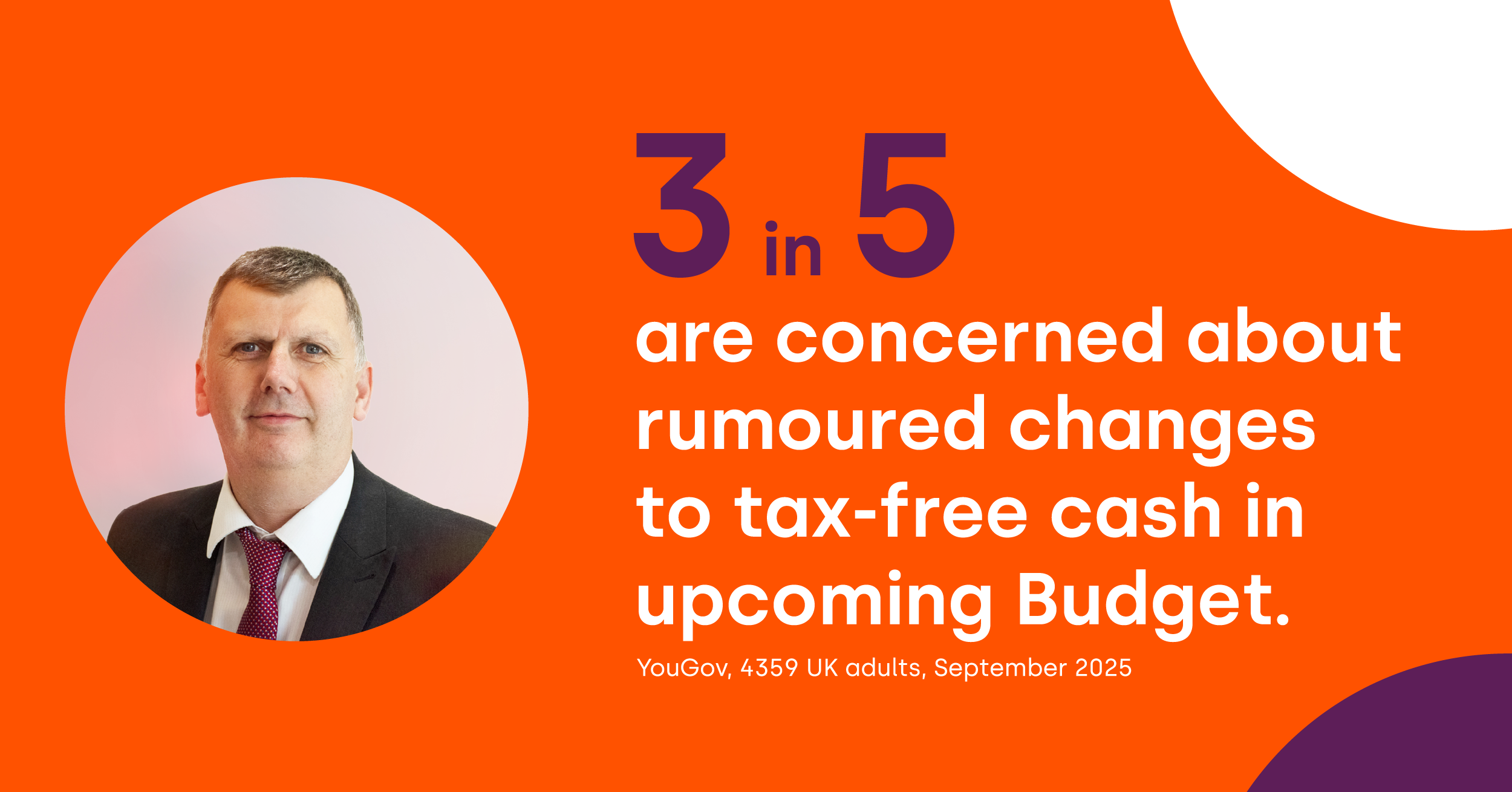

Three in five (59%) people are concerned about rumoured changes to pension tax-free cash rules in the Autumn budget, research by Nucleus has found.

That is double the amount of those (28%) who reported being unconcerned by the speculation. The remaining 13% said they did not know.

There is ongoing speculation that the amount of tax-free cash available from pensions will be cut in the upcoming Autumn budget on 26 November.

Those aged 55 and above can normally take up to 25% of the value of their pension tax-free, up to a maximum of £268,275. Rumours abound that this maximum could be significantly reduced.

Recent data from the Financial Conduct Authority found there was a 29% increase in people taking only tax-free cash from their pension during 2024/25 when compared to 2023/24. That increase is likely to have been driven by last year’s Budget speculation.

Andrew Tully, Technical Services Director at Nucleus, said: “For the second year in a row the UK faces a lengthy run-up to the Autumn budget. This extended period allows the rumour mill to churn given the Government hasn’t clarified its position. Last year’s speculation of potential changes to tax-free rules saw many investors take lump sums from their pensions, with some trying to reverse those actions when no such rule change materialised. There’s a real sense of déjà vu here.

“Long-term planning needs certainty. Speculation can harm confidence and lead to potentially self-destructive behaviours. Ideally the Government will confirm there will be no change to tax-free cash, at least in this budget or for this Parliament, which will give people the ability to plan for their retirement with more confidence.”

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £101bn of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Editor's notes - all press releases should contain the following information

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 4,359 adults. Fieldwork was undertaken between 9 - 10 September 2025. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

Nucleus Financial Platforms, the largest independent adviser platform group in the UK, has promoted Mike Regan into the newly created role of Deputy CEO, effective immediately.

Mike, who joined Nucleus in 2022 initially as CFO, currently acts as Chief Commercial Officer. He’ll retain his current responsibilities, and as Deputy CEO provide support to CEO Richard Rowney in working with the Executive Team to lead the business and develop Group strategy. The creation of this role reflects the ambition and continued growth of Nucleus as one of the leaders in the sector.

Mike has played a key role in driving the group’s transformation since joining, including the acquisition and integration of Curtis Banks and, more recently, Third Financial. He’s also led the commercial team in securing new client wins and driving better outcomes for customers, leading the group’s ongoing investment in proposition development.

Richard Rowney, Chief Executive Officer of Nucleus, said: “As we grow and become more complex, promoting Mike to support me as Deputy CEO was the obvious choice. He’s an exceptional leader who has real commercial and strategic expertise that will help us drive the next phase of our growth, whilst remaining firmly focused on delivering the best possible service for advisers and their customers.”

Mike Regan, Deputy CEO added: “The investment and transformation agenda for a group of our size requires a significant amount of leadership, while the changes in the market and adviser demands means we're constantly adapting and evolving both our business and our proposition.

“I’m really looking forward to taking on the new challenge, working more closely with Richard and continuing to deliver for all our stakeholders.”

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £101bn of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Third Financial, the technology-led platform specialist within the Nucleus group, has today announced a significant extension of its strategic partnership with Titan Wealth Group, to provide an Adviser as a Platform (AaaP) solution to their Wealth Planning Division.

The landmark deal will run for an initial term of five years and is the largest ever signed by Nucleus and one of the biggest deals of its kind in the industry. It has enabled the launch of The Titan Wealth Platform, an end-to-end wealth management service, developed in a matter of months.

Third is powering the new platform through a combination of its Model B custody service and AaaP-specialist technology and will take on full custody of client assets within Titan’s Wealth Planning Adviser business.

The Titan Wealth Platform is already being rolled out across Titan Wealth Planning, with the expectation that several billions of client assets will be migrated gradually from other platforms.

The platform solution will not only help streamline Titan’s operation but also represents a significant growth opportunity for Nucleus, with Titan targeting £100bn in assets under administration over the next three to five years.

Commenting on the deal Andrew Fearon, joint-CEO and Head of M&A at Titan said: “We’ve had a long-standing relationship with Third Financial as the provider of software services to our business. A key driver in deepening the relationship was the capability of the wider Nucleus group to provide an innovative, AaaP solution to power our new platform. It was up and running in only a couple of months and we’ve already transferred almost a billion of client assets.

“The new platform is enabling us to scale and integrate our Wealth Planning business effectively, while our clients will benefit from consolidated financial planning and investment services, an enhanced digital experience and cost efficiencies.”

Mike Regan, Chief Commercial Officer at Nucleus added: “The fact that Titan Wealth Planning has put their trust in us as the driving force behind their new platform, demonstrates that we’re now considered the provider of choice for those larger firms looking to take more control of their Adviser platform proposition. Our combination of market leading technology, personalised service and financial strength continues to set us apart in the market.

“The scale of our operation means we’re uniquely placed to support the growth ambitions of these large wealth groups, and we’re thrilled to be working with Andrew and his team on this transformational partnership.”

Alongside Nucleus’ long-standing retail platform and retirement product propositions, the added wealthtech expertise of Third Financial and Dunstan Thomas means it’s now the only large-scale platform group that offers a comprehensive range of bespoke solutions for advice and wealth management firms of all sizes.

Enquiries:

Linda Harper - Head of Public Relations T: 07876 145309

Philippa Heal - Public Relations Manager T: 07783 314210

E: newsroom@nucleusfinancial.com

Notes to the editors:

About Nucleus

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £101bn of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

About Titan

Titan Wealth was formed in 2021 to deliver industry leading solutions and outcomes to both retail and institutional clients. It offers a vertically integrated set of wealth management solutions spanning financial planning, investment management, platform and custody.

Headquartered in London, Titan Wealth serves clients domestically as well as overseas through its operations in the Channel Islands and to UAE. Today Titan Wealth has approximately £37bn of assets under management or advice.

Nucleus, the largest independent adviser platform group in the UK with over £100bn of assets under administration, has today launched a new CPD learning zone, available to advisers and paraplanners who support all of its propositions - Nucleus Wrap, James Hay, Third Financial, Curtis Banks and Talbot and Muir.

It provides instant access to Chartered Insurance Institute (CII) certified learning and development material, allowing users to refresh existing planning knowledge, and learn more on technical topics and upcoming regulatory change, at a time that best suits them.

The learning zone hosts a suite of exclusive on-demand webinars and live event recordings, presented by Nucleus’ in-house technical experts. CPD certificates are issued upon completion of modules, providing the evidence to help users track their development progress. The learning zone can be accessed through Nucleus’ website via its Illuminate Tech subsection.

The specialist content covered includes structured modules in areas such as ‘An adviser’s guide to taxation of trusts’ and ‘Adding value to clients through effective planning’ modules. There will be a new series of updates specifically focused on the lead-in to the 2025 Autumn Budget, along with an analysis of what Rachel Reeves presents and its implications for financial planning.

Commenting on the new resource for advisers, Nucleus Marketing Director, Stephen Wynne-Jones said: “With Andrew Tully and his team we have some of the industry’s brightest and most knowledgeable technicians, who have decades of experience in helping advisers navigate the complex pensions and tax landscape. Our new learning zone provides a single platform to consolidate all the fantastic resources they create, wrapped around helping advisers with their continuous professional development.”

Andrew Tully, Technical Services Director at Nucleus added: “CPD is important to ensure advisers stay up to date in an ever-changing environment. As its likely many regulatory changes are on the near horizon, our new learning zone makes it even easier for advisers to get up to speed on key topics and feedback what they would like to learn more on, all while working towards their CPD goals.”

Enquiries:

Linda Harper - Head of Public Relations (Monday - Wednesday) T: 07876 145309

E: newsroom@nucleusfinancial.com

Notes to editors:

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers, and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,200 financial advisory firms, the group now administers over £101bn of investments on behalf of over 250,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Nucleus Financial Platforms, the largest independent adviser platform group in the UK, has today announced the appointment of Andrew Ring as Chief Financial Officer.

Andrew will join in September, and as well as becoming a member of the Executive Committee, he’ll also join the group board.

He brings with him two decades of experience working across the financial services sector and a proven track record of operating as a chief financial officer. He replaces Alan McDonald who’s been interim CFO at Nucleus since the end of last year and will remain in role until Andrew starts.

Andrew is currently Chief Financial & Commercial Officer for FNZ in the UK, Middle East and Africa, and before that was CFO for the firm’s UK business. Prior to joining FNZ he was Group Finance Director at Hitachi Capital UK and spent eight years at Barclays Group where latterly he was Finance Director for its UK Corporate Banking division.

Richard Rowney, Nucleus group CEO, said: “We’re delighted that Andrew is joining us. He’s an accomplished finance leader with the skills and acumen that will make a real difference to Nucleus and our ambitious team.

“This is an exciting time as we continue to invest heavily in our proposition and service to drive better outcomes for our customers. Having someone of Andrew’s calibre will help steer our business as we grow and transform in the years ahead.”

“I’d also like to thank Alan McDonald for his leadership as Interim CFO. I’ve thoroughly enjoyed working with him and wish him well for the future.”

Andrew Ring, incoming Chief Financial Officer, Nucleus added: “I’m pleased to be joining Richard and the wider Nucleus team. What they’re building is one of the success stories of the sector, a scale leader that’s sustainably profitable and delivering for its stakeholders. I look forward to getting started and to playing my part in helping drive the next phase of its journey.”

The appointment is subject to regulatory approval.

Enquiries:

Head of Public Relations

Linda Harper (Monday - Wednesday) T: 07876 145309

Victoria Webb (Wednesday - Friday) T: 07969 113758

E: newsroom@nucleusfinancial.com

About Nucleus:

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £99 billion of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Third Financial, part of the Nucleus group, has revealed that investment manager City Asset Management is the latest addition to its growing client roster, marking another milestone in its growth trajectory.

London-based City Asset Management is an independent financial planning and discretionary investment management firm. It has over £800 million in assets under management, which will transfer to Third Financial under an initial five-year partnership.

Commenting on the deal, Ricky Ali, Commercial Director of Third Financial, said: “It’s a vote of confidence in our team that City Asset Management has committed to working with us for the next five years.

“We’ve fast become the preferred partner for businesses who need industry leading, technology-driven solutions backed by exceptional client service. Having the financial might and breadth of capability of the Nucleus group behind us makes a real difference to our conversations with ambitious, investment managers like City Asset Management, looking for a stable, committed, long-term partner”.

Nick Coghill, CEO of City Asset Management, said: “We were seeking a proven technology-led platform partner who could help us to deliver the highest standard of service to our clients.

“With their deep knowledge and experience of the wealth management industry, the team at Third Financial gave us full confidence – not only in their ability to provide a market-leading technology solution, but also in their unwavering commitment to client service and innovation. We’re pleased to be working with them as our sole platform provider.”

Nucleus acquired Third Financial last year. The group offers the broadest range of products, services and software options that enable large advisory firms and consolidators, investment managers and institutions, to take some or all control of their platform propositions.

Enquiries:

Head of Public Relations

Linda Harper (Monday - Wednesday) T: 07876 145309

Victoria Webb (Wednesday - Friday) T: 07969 113758

E: newsroom@nucleusfinancial.com

About Nucleus:

Nucleus Financial Platforms is one of the UK's leading independent groups for investment platforms, products and wealthtech software.

It’s the only large-scale group with a comprehensive range of bespoke platform solutions to meet the needs of advisory and wealth management firms of all sizes.

It operates the Nucleus Wrap and James Hay Online retail investment platforms, and through Curtis Banks and Talbot and Muir is one of the UK’s largest administrators of SIPP and SSAS products.

With the wealthtech experience of Third Financial and Dunstan Thomas, Nucleus now powers some of the industry’s leading product providers, advisory firms and consolidators, discretionary investment managers and institutions, with enterprise-wide, platform software solutions.

Working exclusively in partnership with over 5,300 financial advisory firms, the group now administers over £99 billion of investments on behalf of over 230,000 UK customers, seeking to deliver great service and financial outcomes for them, and ultimately help make their retirement more rewarding.

Useful downloads

Here's our logo with three different versions available. Please email our graphic designer Iona Sorbie if you’d like an alternative version.

Media contacts

Our communications team is supported by The Lang Cat and TB Cardew.

If you're a journalist and would like to receive our corporate announcements please email: