Media hub

1 December 2025

Foster Denovo extends platform partnership with Third Financial

Wealth manager Foster Denovo has extended its strategic partnership with Third Financial, part of the Nucleus group, signing an exclusive deal for a bespoke Adviser-as-a-Platform (AaaP) solution.

Read our latest press releases

25 November 2025

Pre-Budget speculation and policy tinkering damaging consumer confidence in retirement says Nucleus

Unhelpful pre-Budget speculation including possible changes to tax-free cash and political tinkering with rules around pensions has damaged retirement confidence among savers...

12 November 2025

Retirement confidence hits new low ahead of budget as calls grow for policy stability and early financial education

The third annual UK Retirement Confidence Index from Nucleus shows only one in four UK adults are confident they’ll have enough money to live comfortably in retirement.

6 November 2025

Verso Asset Management to transfer custody to Third Financial in new five-year deal

Verso has extended its strategic partnership with Nucleus, transferring the custodial operations of its investment management arm to Third Financial under an initial five-year deal.

Archive

The FCA today released its retirement income data for 2022/23 (Retirement income market data 2022/23 | FCA).

A summary of the data is detailed in the table below.

| 2021/22 | 2022/23 | |||

|---|---|---|---|---|

| Number of plans | Monetary value (£000) | Number of plans | Monetary value (£000) | |

| Total pots accessed for first time | 705,661 | 45,638,188 | 739,535 | 43,199,189 |

| Annuities purchased | 60,574 | 5,153,150 | 59,163 | 4,060,947 |

| New drawdown policies entered into and not fully withdrawn | 205,641 | 31,794,619 | 218,074 | 29,867,353 |

| Pots where first partial UFPLS payment taken and not fully withdrawn | 36,271 | 3,693,212 | 41,571 | 4,002,707 |

| Full cash withdrawals from pots being accessed for first time* | 395,235 | 4,997,207 | 420,727 | 5,268,182 |

It shows:

- Slightly more pots (4.9% higher) were accessed for the first time in 2022/23 than in 2021/22 (739,535 vs 705,661).

- However the monetary value was down, suggesting more people took out slightly lower value withdrawals.

- The percentage of customers using the different solutions has remained broadly constant.

- In monetary terms the majority of funds go into drawdown.

- In customer numbers most take full cash withdrawals.

- Sales of annuities fell slightly, which is probably a surprise given rates have generally been good.

- The number of DB transfers continued to fall.

Andrew Tully, Technical Services Director at Nucleus Financial, said: “The effects of the cost-of-living crisis will unfortunately be felt for years to come, so it’s no surprise to see greater numbers of people making withdrawals from pensions than in the previous tax year. We have recently conducted some consumer research which revealed that 74% of UK adults cite ‘affordability’ as one of the issues that negatively affects their retirement confidence. That figure rises to 81% of those aged between 45-54. Many people need to access their pension while still working to pay unexpected bills or help wider family.

“Drawdown will remain the key retirement solution for many as it gives the flexibility to cope with changing needs in retirement. Given the ongoing freezing of the tax thresholds, being able to vary income to ensure it is taken as tax efficiently as possible is a key benefit. The increase in advised annuity sales isn’t a surprise given the significantly higher rates. But blending drawdown with a guaranteed income may give a better outcome than solely using an annuity.

“Given the range of retirement options available, it is important consumers get good advice at the point they first access their pensions savings and on an ongoing basis to work out the best options for their individual circumstances.

“Drawdown advice can be complex, covering areas such as the sustainability over a long time period; the ideal investment options; and tax advice, including how to pass on wealth efficiently to family. Advisers need to be clearly documenting their advice as that is one of the areas the FCA focused on during its retirement income advice review.”

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £89 billion in assets under administration, helping nearly 5,500 advisers make retirement more rewarding for almost 235,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform and product groups, has appointed Julia Peake as Technical Manager, further strengthening its Technical Services team.

Julia joins from Canada Life where she was a technical specialist for three years, and previously worked for Sanlam. In a career spanning over 20 years in financial services, she’s held a number of roles working with providers, wealth planners and national advisory networks in pension, tax, trust and estate planning.

Reporting to Andy Tully, Technical Services Director, Julia will be part of Nucleus’ specialist Technical Services team, supporting advisers and helping to shape the group’s overall proposition.

Following the acquisition of Curtis Banks, Nucleus has brought together its 15 strong team of technical specialists into a single centre of excellence.

The team creates bespoke technical content and attends both Nucleus-led and wider industry events sharing technical expertise and insight to deepen advisers’ understanding of the ever-changing financial landscape, and how they can deliver better outcomes for their clients.

They also work with industry groups and regulators, along with other statutory bodies, to champion financial planning and campaign and lobby for change to ensure greater political consensus around pension and long-term savings policy.

Andy Tully, Technical Services Director, said: “We’re delighted to welcome Julia to Nucleus. Her expertise will strengthen our team supporting advisers as they wrestle with the complexities of taxation and pensions so they can support their clients.

“She joins at a crucial time given the number of recent changes. Our role is to help advisers navigate these so that they can ultimately help make retirement more rewarding for their clients.”

Julia Peake, Technical Manager at Nucleus, added: “I’m thrilled to join Nucleus’ respected technical team. With an uncertain policy roadmap and a potential change of government later this year, there’s lots to do to support advisers helping them to keep on top of the changes and to deliver exceptional support to their clients.

“It’s great to be working with Andy again and everyone across Nucleus has been so welcoming. I’m looking forward to playing my part in helping to build the best retirement platform for advisers and their clients.

“In these uncertain times, with widespread cost-of-living concerns and volatile markets, it’s more important than ever to improve understanding of pensions, taxation and building a holistic financial strategy so that more people can feel confident about their financial future.”

You can download a PDF of the press release here

ENDS

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £89 billion in assets under administration, helping nearly 5,500 advisers make retirement more rewarding for almost 235,000 customers.

To find out more visit: www.nucleusfinancial.com

- Nucleus Financial Platforms has reached an agreement to acquire Third Financial, one of the fastest growing investment platform and software providers in the UK.

- The acquisition is subject to regulatory approval and will enable Nucleus to offer a full range of platform solutions to meet the needs of advisory and wealth firms, including ‘adviser-as-a-platform’.

- Third Financial will continue to be led by existing Chief Executive Ian Partington, and benefit from the opportunities provided by the wider group.

Nucleus Financial Platforms, one of the UK’s largest adviser platform groups with over £80bn of assets under administration from 250,000 customers, announces the acquisition of Third Financial.

Third Financial is a leading investment platform and front-to-back wealth management software provider, serving discretionary wealth managers, multi-family offices, and adviser consolidators.

The business has delivered strong organic growth in recent years, with revenue increasing by more than 30% in 2023. It has over 50 clients in the UK with £6bn of assets under administration on its platform and a further £40bn of assets administered via its software system, Tercero.

The acquisition will enable Nucleus to extend the platform solutions it offers advisory firms of all sizes. As well as the existing leading retail retirement platform and specialist SIPP and SSAS products, Nucleus will benefit from Third Financial’s proprietary technology, enabling an enhanced ‘adviser-as-a-platform’ proposition to meet the needs of larger businesses who want to offer their own platform.

The move represents a sizeable growth opportunity, as research by NextWealth* showed that an increasing number of larger advisory groups were exploring establishing their own platform as a way of increasing revenue, reducing risk, and improving operational efficiency. The key benefit to advisers of this approach is the provision of greater control over the products, service, and price.

The combination with Third Financial is fully aligned with the group’s strategic ambition of building scale and capability through organic growth and compelling acquisition opportunities.

Upon completion, the group’s platform AUA is expected to be circa £90bn.

Richard Rowney, Chief Executive Officer of Nucleus, said: “We're delighted to announce the acquisition of Third Financial. By combining our scale, expertise and relationships, with their innovative technology, we’ll be able to offer a broader proposition to serve the needs of wealth managers and advisory businesses across the sector.

“We’ve long admired the team that Ian has built at Third Financial and what they’ve achieved. Their focus on innovation and client centricity has clearly differentiated their business, establishing them as one of the leading investment platform providers, and they will be a great addition to our group.”

Ian Partington, Group Chief Executive of Third Financial added: “A crucial factor in the decision to join Nucleus is that we feel very culturally aligned. Delivering excellence for our clients has always been core to our success, and in the Nucleus team we found that quality fully reflected.

“Now with our combined expertise and resource we can deliver even more to existing and future clients both in terms of products and service. Collectively our focus will remain on running a stable and profitable expanded service, continuing to support clients so they can deliver great outcomes for their customers.”

Nucleus is being advised by Fenchurch Advisory Partners and Slaughter and May.

Third Financial is being advised by GP Bullhound and Osborne Clarke.

* NextWealth the Great Platform Shakeout Report January 2023

Research by NextWealth showed that an increasing number of larger advisory groups were considering offering their own platform, as a way of reducing their risk and improving operational efficiency. The key benefit to advisers of this approach is that it provides more control over the products, service and price.

You can download a PDF of the press release here

ENDS

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Tom Allison/Shan Willenbrock

TB Cardew

T: 0778 9998020/07775 848537

Notes to editors:

About Nucleus

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

About Third Financial

Third Financial is the UK's leading investment platform for the thinking wealth adviser and manager.

It brings together its own market-leading technology and the expertise of over 100 industry professionals within a culture of exceptional client service.

It provides the core processing, asset servicing and market connectivity for the management of over £50bn of assets.

It delivers a full digital experience to wealth professionals and their clients with the reassurance of friendly and expert support when required.

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, has announced the removal of exit fees for customers of Curtis Banks SIPP products.

The change will apply to transfers out to UK based pension schemes and annuity purchases.

It follows the removal of the remaining exit fees on James Hay products last year, as well as a further reduction in the price of Nucleus Wrap.

Nucleus’ commitment to using its scale to invest in price has saved the group’s customers over £5m in the last two years, with a further £5m expected to be saved in 2024 through the combined price reductions.

Mike Regan, Nucleus Chief Commercial Officer, said: “I’m pleased that following our acquisition of Curtis Banks last year, we’re now removing exit fees. We don’t believe any customer should face unreasonable barriers to exit if they wish to leave, for whatever reason.

“Looking ahead to 2024 we’re excited about the prospect of continuing to invest in our products, service and price, enabling us to deliver great financial outcomes for our customers and ultimately helping make their retirement more rewarding.”

The exit charges this applies to are as follows:

- Final payment and closure of pension charge

- Transfer out charge

- Annuity purchase charge

- Forwarding monies post pension closure charge

You can download a PDF of the press release here

ENDS

Enquiries:

Linda Harper

Head of Public Relations - Nucleus Financial Platforms group

E: newsroom@nucleusfinancial.com

T: +44 (0) 7876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus has reignited its call for an independent long-term savings commission with an open letter to the pensions minister and his counterparts across political parties.

The firm urges there needs to be greater cross-party agreement for pension and savings policy to ensure more people can feel confident about their retirement prospects..

It has called for a stop to the constant tinkering to pension tax rules, which is deterring people from engaging with the pension system.

Nucleus has written to pensions minister Paul Maynard and shadow minister for pensions Gill Furniss, among others, highlighting that pension savers want to see a stable tax and policy environment.

The pension legislation merry-go-round of recent years has further eroded trust at a time when people need to be saving more for later life.

Auto-enrolment has successfully created millions of new savers, but people are not saving anywhere near enough for a comfortable retirement.

Nucleus highlights the policy, proposed by an independent Pensions Commission in 2005, had wide cross-political party support from the outset and continues to do so today.

It suggests a similar independent body needs to be established now to bring the much-needed consistency to pension savers.

The letter follows a research study conducted by Nucleus last year in which it asked the thought-provoking question: ‘How confident are you that you’ll have enough money to live comfortably for the rest of your life?’

As part of the 2023 Nucleus UK Retirement Confidence Index, 2,000 adults aged 50 and over were polled by YouGov to gauge how they feel about some of the most important decisions they will need to make around retirement.

The study highlighted pension savers want to have trust in the long-term savings market. It included consumer and adviser research and demonstrated the need for greater collaboration to effect positive change.

This new annual index will track UK retirement confidence over time. The inaugural report contained 14 calls to action for the industry, policy makers and consumers, around pensions legislation, financial education and communication.

One of the major arguments put forward was the need for an independent long-term savings commission. Nucleus has reiterated this call in the letter.

Andrew Tully, Technical Services Director at Nucleus and author or the letter, said: “To make meaningful positive change to long-term savings habits, our recent UK Retirement Confidence Index highlighted that we need more people to save more into their pension, to understand why they are saving and what for, and are empowered to save in an environment of trust and stability.

“Our research suggests constant tinkering and changes to rules has a negative impact on confidence. Setting up an independent long-term savings commission to depoliticise and develop proposals for pension and savings policy would bring much needed consistency and stability, which would deliver greater levels of trust and engagement.”

Nucleus outlines the aim of such a non-departmental public body would be to review the regime for UK pensions and long-term savings and make recommendations accordingly.

You can download a PDF of the press release here

A full copy of the letter follows:

Proposal to establish an independent long-term savings commission

Nucleus is one of the largest, independent investment platforms in the UK. We help over 250,000 customers manage a collective £80bn of their wealth, exclusively through independent financial advisers. Our purpose is to help them make retirement more rewarding.

We take our responsibility as the custodian of customers’ money very seriously. As such, we believe the UK needs greater political consensus around pension and long-term savings, to help more people save more for their retirement in an environment of trust and stability.

One way to achieve this would be to establish an independent long-term savings commission.

We recently conducted a major piece of customer research, The Nucleus UK Retirement Confidence Index. Via YouGov, we sought to assess whether people over the age of 50 have confidence they’ll be able to retire comfortably.

In these uncertain times, with widespread cost-of-living concerns and volatile markets, it’s more important than ever for people to feel confident about their financial future.

Our research clearly – and predictably - highlights those with defined benefit (DB) pensions are most confident. But we know DB is in sharp decline following most private schemes being closed to new joiners or bought out over the past 20 years, and there’s a rapidly growing reliance on defined contribution (DC) pension provision. We’ve evidenced that those relying solely on DC pensions are much less confident of their financial future.

Automatic enrolment is one key policy that has been a huge success in getting more people to save for their retirement, within the DC environment. This policy was proposed by an Independent Pensions Commission in 2005. Perhaps at least partly because it was proposed by an independent body, the introduction of auto-enrolment had from outset, and continues to have, wide cross-political party support.

While auto-enrolment has successfully created millions of new savers, it’s widely agreed that people are not saving anywhere near enough. The complexity of retirement and tax planning involved in turning a pot of money into a retirement income can’t be overstated.

Added to that people need to decide when and how to use money held in other assets such as ISAs, investments and property, alongside pension savings.

There are many persuasive reasons for people to not engage with their retirement, both practical and psychological.

Building up informed, appropriate retirement confidence will require co-operation, communication, and collaboration. Each and every participant in the retirement income sector has a role to play – and should feel obliged to play.

A key area highlighted within our research is the desire for pension savers to have trust in the long-term savings market and have a stable tax and policy environment. Pensions are a long-term investment, and over many years, under various different governments, there have been constant changes and tinkering to the pension tax rules which deter people from engaging with the pension system, and negatively affects their confidence.

To make meaningful positive change, our research highlights we need more people who save more into their pension, to understand why they are saving and what for, and are empowered to save in an environment of trust and stability.

It’s for this reason that we believe the creation of an independent long-term savings commission is needed. The aim for this non-departmental public body would be to review the regime for UK pensions and long-term savings and make recommendations accordingly. Its existence should make it easier to gain cross-party support for proposed changes and engender more stable pensions and long-term savings policy. And ultimately give more confidence in retirement.

I’m more than happy to meet and discuss our research and thoughts in more detail, along with our CEO, Richard Rowney. I look forward to hearing from you.

Yours sincerely

Andrew Tully

Technical Services Director

ENDS

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £89 billion in assets under administration, helping nearly 5,500 advisers make retirement more rewarding for almost 235,000 customers.

To find out more visit: www.nucleusfinancial.com

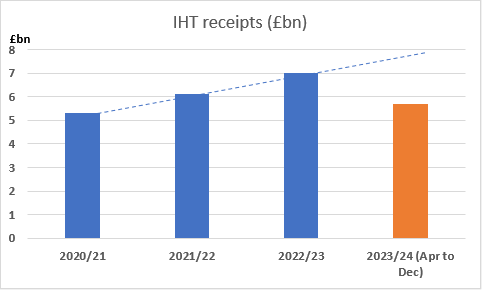

HMRC announces the latest Inheritance Tax (IHT) receipts, within their wider tax receipts document. HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) - GOV.UK (www.gov.uk).

- Total HMRC tax receipts for April 2023 to December 2023 are £580.8 billion, which is £26.0 billion higher than the same period last year.

- IHT receipts for April 2023 to December 2023 are £5.7 billion, which is £0.4bn billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may either scrap IHT entirely or cut the headline rate in the March Budget.

- However, even if IHT were scrapped it is possible some tax would apply to assets passed on after death – for example, Capital Gains Tax.

- The Labour party has said that if it wins the election it would reverse any abolition of IHT.

- Given all of this the need for expert financial planning remains crucial.

Andrew Tully, Technical Services Director at Nucleus said:

“It looks set to be another record-breaking year for IHT receipts. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions, given this year’s receipt are on track for around £8bn.“There are rumours the Government may consider changes to, or even the abolition of, IHT. However, with the possibility of other taxes applying to assets passed on after death, and Labour saying it would reverse any abolition, the need to engage early with planning and advice is crucial. Advisers can help manage an estate by setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

To download the PDF click here

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self-invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Nucleus Financial Platforms, one of the UK’s leading, independent, adviser platform groups, has today announced that after a distinguished period of technical leadership and delivery, Andrew Smith is stepping down as Chief Digital Officer from the end of the year.

Richard Rowney, Nucleus Chief Executive Officer said: “Andrew has been a key part of Nucleus throughout its journey. He was one of the team that helped launch the wrap platform in 2006, playing a pivotal role by ensuring we focused on the needs of advisers in those early years. After rejoining in 2015, he’s greatly contributed to the growth and transformation of the business, leading the development of our proposition through our investment in digital and technology.

“As part of my leadership team for the last two years, his support and contribution through the integration of Nucleus and James Hay has been invaluable. I would like to thank him for his commitment and leadership and wish him the very best for the future.”

Andrew Smith, Nucleus Chief Digital Officer said: “I’ve spent much of my career at Nucleus so it’s very much part of my DNA, but after a total of 13 years, I feel that now is the right time to look for a new challenge.

“I’m really proud of what we’ve achieved. From a start up in Edinburgh in 2006 to the scale business we are today, it’s been a quite remarkable journey, not least as we’ve held onto our founding principle of serving the needs of advisers and delivering great customer outcomes. It’s been a privilege working with such brilliant teams over the years and I look forward to watching the continued success of the company.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Nucleus Financial Platforms group

T: 07876 145309

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

- The cut will deliver an average 3.2% reduction for eligible customers.

- Under the new standard pricing structure, a customer with assets of £500,000 would see their charge reduced by £450 over five years.

Mike Regan, Chief Financial Officer at Nucleus said: “We’ve been clear that as we build scale this allows us to invest more in our service, product and price. I’m pleased that we are now sharing the benefit of our increased scale by introducing our second annual rate cut for Nucleus Wrap.

“This latest price reduction increases our competitiveness, and more importantly, delivers an improved outcome for many of our customers, who collectively will have saved more than £10m by the end of next year.

“Over the last 18 months we’ve invested more than £20m in our proposition, service and price as we deliver against the priorities of advisers, helping them to make their clients’ retirement more rewarding.”

New Nucleus Wrap customer standard charging structure

|

Previous charges |

New charges |

||

|---|---|---|---|

|

Tier |

Standard charge |

Tier |

Standard charge |

|

£0 to £0.5m |

33bps |

£0 to £0.2m |

33bps |

|

|

|

£0.2m to £0.5m |

30bps |

|

£0.5m to £1.0m |

17.5bps |

£0.5m to £1.0m |

17.5bps |

|

£1.0m+ |

5bps |

£1.0m+ |

5bps |

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Richard Rowney, Chief Executive Officer at Nucleus, said: “Alexander has three decades of experience in the financial services sector and brings with him knowledge and expertise that will be instrumental in helping us to deliver on our strategy, as we continue to invest in our platform and build scale.

“This is an exciting time in our journey and I look forward to having Alexander in my executive team as we build the UK’s leading, independent, adviser platform.”

Alexander Filshie, Nucleus CFO, added: “I’m delighted to be joining Nucleus at this exciting time, as it embarks on the next phase of its journey to become a scale player in the market, with a clear commitment to invest in the priorities of advisers and to deliver on its purpose to help make retirement more rewarding for customers.

“I’ve been extremely impressed by the trajectory of the business and in particular the vision and ambition of Richard and the wider executive team. With strong shareholder backing, and a strategy that is clearly working, Nucleus is well positioned to continue to capture the significant opportunities that exist in the platform market.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 5,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

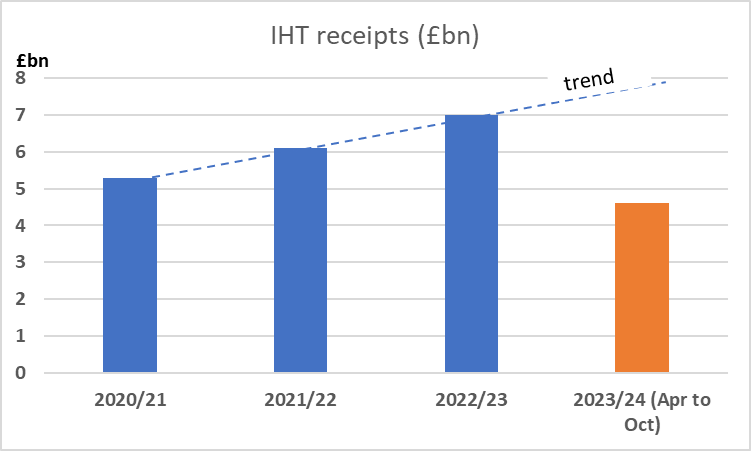

- For April 2023 to October 2023 these are £4.6 billion, which is £0.5 billion higher than the same period last year.

- This suggests last year’s record breaking IHT receipts of £7bn look set to be broken again, continuing the strong upward trajectory over the last few years (see graph below).

- The current £325,000 nil rate band has been at that level since 2009. The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate band (making a total of £500,000) subject to certain rules.

- Both are currently intended to be frozen until 2028.

- There are rumours the Government may cut the headline rate of IHT in the Autumn Statement tomorrow.

Andrew Tully, Technical Services Director at Nucleus said: “It looks set to be another record-breaking year for IHT receipts, unless the Government moves to cut the headline rate as rumours suggest. And with the Office of Budget Responsibility predicting the IHT take will be £8.4bn in 2027/28 receipts are set to continue growing strongly, despite slower house price growth, and may well exceed those OBR predictions.

“Engaging early with good planning and advice can help to reduce or mitigate IHT. There are a number of ways advisers can help manage an estate for IHT purposes including setting up trusts, making use of gift allowances, and using a pension to pass on wealth to family in a tax efficient way.”

You can download a PDF of the press release here

Enquiries:

Linda Harper

Head of Public Relation

E: newsroom@nucleusfinancial.com

Notes to editors:

The Nucleus Financial Platforms group offers investment platforms and products exclusively to financial advisers, that ultimately help make retirement more rewarding.

Renowned for its SIPP expertise, James Hay Partnership has been working with larger financial advisory groups for more than 40 years, providing the means to administer pensions, savings and investments in a cost and tax efficient way.

Our award-winning platform Nucleus was founded in 2006 by advisers committed to altering the balance of power in the industry by putting the customer centre stage.

Curtis Banks is one of the UK’s largest administrators of SIPP and SSAS solutions for customers and businesses. It is one of Europe’s largest commercial property landlords, a specialist area for self invested pensions. The business maintains a focus on providing high levels of technical support, robust service, modern technology and innovation.

Together we’re one of the UK’s leading, independent, adviser platform and product groups, with approximately £80 billion in assets under administration, helping nearly 6,000 advisers make retirement more rewarding for almost 250,000 customers.

To find out more visit: www.nucleusfinancial.com

Useful downloads

Here's our logo with three different versions available. Please email our graphic designer Iona Sorbie if you’d like an alternative version.

Media contacts

Our communications team is supported by The Lang Cat and TB Cardew.

If you're a journalist and would like to receive our corporate announcements please email: